Decomposing the Move in Yields…Global Fixed Income Coming Closer to Decoupling from German Bunds

MarketsMuse Global Macro and Fixed Income departments merge to provide insight courtesy of “Sight Beyond Sight”, the must read published by global macro think tank Rareview Macro LLC. Below is the opening extract from 10 June edition.

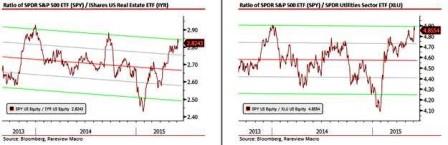

Firstly, please note this morning’s Model Portfolio Update: Crude Oil, XLU/SPY, IYR/SPY, FXI: As per yesterday’s edition of Sight Beyond Sight, we added to existing long positions in Crude Oil, XLU/SPY and IYR/SPY. The update was broadcast in real time via @RareviewMacro.

Now, on to the day’s primary talking points..

The confidence level in the professional community remains low. The attack on the Dollar-Yen (USD/JPY), which had its largest one-day drop since August 2013, was just another casualty of the search and destroy mission underway in overall asset markets. The fact is that there is no model–valuation, technical, or otherwise–that can handicap the speed and the degree of the backup in global yields. The overriding question remains: “When will global yields stop going up, and when can the rest of fixed income decouple from German Bund leadership?”

Risk-Adjusted Return Monitor Summary & Views Continue reading