MarketsMuse curators have canvassed assortment of guru-types who have attempted to decipher Friday’s stock rally, along with tuning in to the abundance of Monday morning quarterback views. For those who turn to the cartoon channel (i.e. CNBC), some pundits call it a dead cat bounce, more optimistic professional traders and pontificators would like to believe the spike on Friday is a sign of a “bottoming formation”–irrespective of many signals that suggest the “R-word” will become more frequently used when describing the state of the US economy. Smarter money, particularly those who have Sight Beyond Sight are focusing on following a private weekend comment summarizing last Thursday’s email newsletter from global macro think Rareview Macro…

Factually the 14-day (Relative Strength Index) or “RSI” on the SPX Index is now 39; no one with a straight face can say the market is oversold technically. Last week, when the S&P futures bounced off the lows the professional community was open to the notion that the index could trade back up into the 1920-1960 range. That has not happened despite three key things:

- President Draghi has backing of the Committee now to ease policy further;

- The FOMC was dovish and the implied probability of a hike in March now is at 18% (it was ~28% yesterday); anything below 20% most likely means it’s going to zero; unconditional probability of June is exactly 20%; post-March FOMC that is most likely around 33% or 3 to 1 AGAINST;

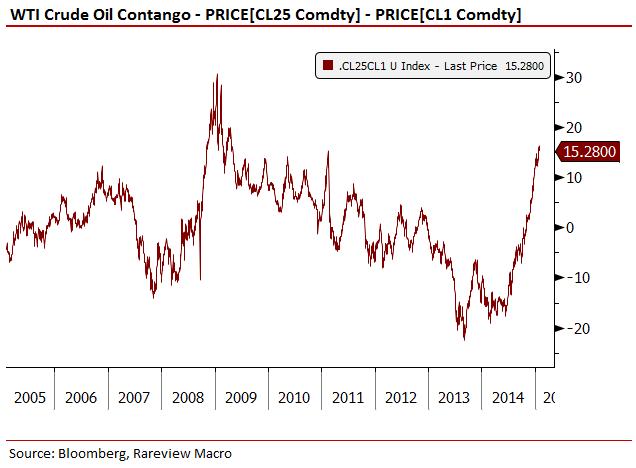

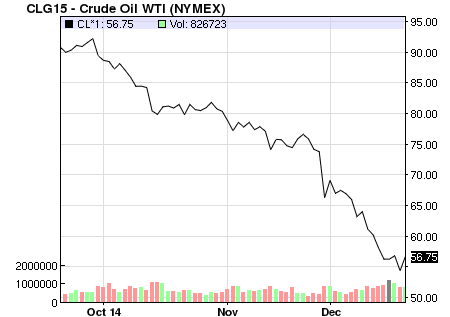

- Crude oil has taken out last week’s highs multiple times and broken the downtrend channel today on an intra-day basis. Additionally, the market has removed the majority of event risk related to Yen and Nikkei heading into the BoJ meeting tonight on the view that if the BoJ eases they go big (20 bonds, 1-3 ETF, and even cut IOER) because they can’t risk an incremental easing that the market rejects.

The key question is with largely every asset now discounting these central bank events and the high degree of correlation of risk assets to crude oil, especially the S&P 500, why has the S&P not responded and traded up to the expected range of 1920-1960?

The answer is that tomorrow the BEA releases their quarterly update for corporate profits (Bloomberg Ticker: CPFTYOY Index). Last quarter it was down -5.74%. The key point being is that tomorrow brings a likely confirmation of two-quarters in a row of declining profits – or a “profit recession”. Remember, this is a clean look at profitability and there are no footnotes like a company specific earnings release that can attempt to paint any Picasso they want.

Additionally, ISM Manufacturing data is released on Monday and in order for the cyclical call bounce to begin to materialize it can’t show another print to the downside. Right now the market has shifted to a 40-50% probability of a forthcoming recession up from 10-20% to start the year. Confirmation of further ISM Manufacturing weakness will only accentuate the view that 11 of the last 13 recessions included ISM Manufacturing printing below the 50 level.

So while you may have to wait for two-quarters in a row of negative GDP at some point in the future to get formal confirmation of a recession, the risk is that corporate profits and manufacturing will govern risk assets for the time being and outweigh the heavy emphasis the Ph.D. community places on the consumer and a services-driven economy for now.

When you marry all of this with corporate earnings season that is now half-way complete, with the exception of Facebook (NYSE:FB), not one icon company has had a good print or said something truly positive in the outlook. In fact, AAPL is very close to touching its 200-week moving average like Russell 2000 and Transports. The last time that happened was during the GFC.

Finally, Friday was month-end and the bulls will lose the call for further pension re-balancing that showed equities were very large to buy. The risk now, with all of the oversold conditions worked off, is that the S&P 500 resumes its downtrend and like every other risk asset the 200-week moving average of 1704 is a magnet.

Interest Rate Probability Dispersion Post-FOMC:

- Hike Twice March AND June: 6%

- Hike Once March OR June: 36%

- NO Hike At All by June: 58%

Rareview Macro is the publisher of “Sight Beyond Sight“, a subscription-based advisory service for professional investors, hedge funds and self-directed investors and offers actionable trade ideas using futures, options, and ETFs within the framework of a disciplined analysis process. Author Neil Azous publishes intra-day updates re model portfolio and trade posts via Twitter @rareviewmacro