Decomposing the Move in Yields…Global Fixed Income Coming Closer to Decoupling from German Bunds

MarketsMuse Global Macro and Fixed Income departments merge to provide insight courtesy of “Sight Beyond Sight”, the must read published by global macro think tank Rareview Macro LLC. Below is the opening extract from 10 June edition.

Firstly, please note this morning’s Model Portfolio Update: Crude Oil, XLU/SPY, IYR/SPY, FXI: As per yesterday’s edition of Sight Beyond Sight, we added to existing long positions in Crude Oil, XLU/SPY and IYR/SPY. The update was broadcast in real time via @RareviewMacro.

Now, on to the day’s primary talking points..

The confidence level in the professional community remains low. The attack on the Dollar-Yen (USD/JPY), which had its largest one-day drop since August 2013, was just another casualty of the search and destroy mission underway in overall asset markets. The fact is that there is no model–valuation, technical, or otherwise–that can handicap the speed and the degree of the backup in global yields. The overriding question remains: “When will global yields stop going up, and when can the rest of fixed income decouple from German Bund leadership?”

Risk-Adjusted Return Monitor Summary & Views

There are a fair number of paid forecasters who work at “Hindsight Capital” declaring victory and suggesting that the Bund move is already largely complete. For some who rely on valuation to dictate what clothes they wear, today, German Bund yields have reached their core bear targets of 1% to 1.10%. For others, especially those that chart mine for a living, want to believe that the 50% Fibonacci level going back to September 2013 when global yields topped due to the Federal Reserve not tapering their asset purchase program is symbolic in finding a floor in prices.

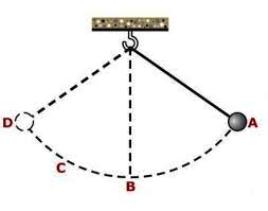

The key question for us however, is whether the pendulum in European fixed income yields has now swung far enough to the point where fair value is visible, but with the same degree of conviction when the conversation around yields were solely driven by the supply and demand dynamics of sovereign bond issuance, and the added risk premia associated with a “Grexit” just a short while ago.

The answer is: we are not there yet. It is only at that point can we make the call that fair value will overpower the real money long selling and slow the momentum with a straight face. Below are some of the inputs we are using to determine when the pendulum has truly overshot and the visibility turns into confirmation.

Here is what you need to know in terms of fundamentals for European bond markets.

To read the entire analysis from Rareview Macro’s “Sight Beyond Sight” commentary, please click here