“To put it bluntly, what headline writers or traders are selling you today is a load of bollocks.” Neil Azous, Rareview Macro LLC

When global macro guru Neil Azous of Rareview Macro appeared on CNBC midday yesterday, MarketsMuse curators had already absorbed and relayed his recent views about energy prices, as well as his relatively rare (and sober) view as to the mid-term outlook for equities. When he opined late last night, “You date equities, but you marry credit..” via his Twitter feed, MarketsMuse Fixed Income curators smirked; simply because our resident bond market experts have long held that rare view–one that today’s “young Turks” often fail to appreciate.

Whether Monday’s equities market action was merely a ‘dead cat bounce’ in a progressively deteriorating state of market metrics that some attribute to a cyclical ‘earnings recession’, or a firming up of the underlying financial market foundation that portends “higher for longer” stock prices, its good to have sight beyond sight…

Consensus is a Classic Counter-Trend Tuesday…You Date Equities but Marry Credit

To put it bluntly, what headline writers or traders are selling you today is a load of bollocks.

Emerging market equities have just recorded their largest five-day gain since the taper tantrum in June of 2013. While the historical precedent is not the same the absolute performance is of similar magnitude for developed market equities. The prevailing view is that this is on account of a weaker US dollar, and on the view that lower interest rate for longer will be supportive for global growth.

As a gesture of goodwill by the Bulls, after five days of impressive stock gains, and for no other real reason, the consensus view is that today is a classic counter-trend Tuesday.

We have to chuckle to ourselves over this, because just last week, a stronger US dollar and an imminent interest rate increase that would remove the Federal Reserve uncertainty were also viewed as positive for equities. There is not even an acknowledgement that the move off the lows in the S&P 500 is very similar to the market bounce seen at end of August, and we all know how that worked out.

We’ll leave the narrative spinning to everybody else and, as we do every day, just try and deliver you some sight beyond sight.

One would think that this large group of people, all of whom consider themselves students of the market, would include a few other basic factors in their headline writing or analysis, such as:

- The BoJ meeting tonight;

- The ECB and BOE meeting minutes on Thursday;

- Dead-cat equity market bounces of this magnitude are thematic during bear markets;

- Reluctant buyers ahead of earnings season, especially considering a mini-theme of negative pre-announcements beforehand has already begun.

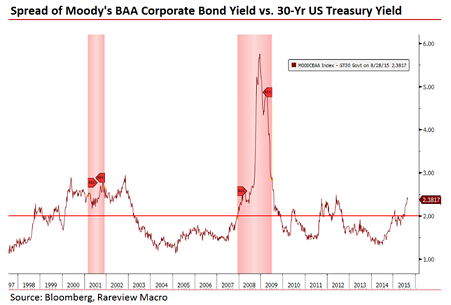

We suppose the list of data points could go on and on, but for us the key driver for risk assets is whether financial conditions tighten or loosen. We are watching corporate-based measures closely for that insight, not just the traditional market-based measures the majority on the Street monitor.

Despite the bounce in equity markets, a minor step-change in sentiment around the energy sector, which is supportive for inflation expectations, and the minor relief that a weaker US dollar and lower interest rate profile provides, there really has been no loosening in financial conditions over the past five days.

The breakdown in correlation between equity and credit markets is too hard to ignore, especially if you are looking for the upturn in equities to show durability beyond the past five days.

Here are three examples from yesterday of what we mean by this disconnect between stocks and credit and how credit is struggling with the tight financial conditions. These are just some of the corporate-based, as opposed to market-based, measures we are referring to.

- Ford Credit (F), a BBB rated issuer, came to market with a two-part 3-year fixed and floating rate note deal. Later in the day, the 3-year fixed notes were sold after combining its fixed and floating rate tranches. Additionally, it was forced to pay a 35 to 50 bps concession over its nearby 3-year fixed issue to print new paper. The key takeaway is that with a BBB rating, in this type of market, Ford would only issue if it “needed” to, not because it would do so opportunistically. Accordingly, the market is making them pay up for this new paper.

- The Province of Ontario (a sovereign-type issuer that is rated A+) stood down from issuing a €2.5bn 10-year deal due to “market conditions”, even though the deal had already been pre-marketed (i.e. investors knew of and were prepared to buy the deal).

The lead managers released the statement below. This is extraordinary to say the least and illustrates how even the best credits are being very cautious… “Ontario always tries to right size its transactions and provide a liquid benchmark sized offering. The Province views the USD and EUR markets as core strategic markets and, as such, wants to maintain a well-defined liquid yield curve in each currency. Market conditions were today such that Ontario could not meet these objectives and, as a result, has decided to step back from the market at this stage and would like to thank investors for their interest.”

- Five (5) other IG deals were known to have stood down from coming to market yesterday, following the decision by the Province of Ontario. (Source: Mischler Financial, Quigley’s Corner, Ron Quigley)

In our view, we do not expect financial conditions to confirm the recent equity bounce. In fact, we think tighter financial conditions will be a key determinant in why the fourth quarter positive seasonal call will struggle this year despite the stock trader’s almanac always saying otherwise.

Firstly, we have already made our views very clear on how one major financial condition – the corporate financing gap – has now swung into deficit. And we have pointed out the consequences of that: it will limit their ability for further credit issuance, M&A will cost more, and stock buybacks will slow, and that collectively has led to the Street being way too generous in its fourth quarter forecasts for all of these metrics.

In fact, we were pleased to see Deutsche Bank yesterday echo what we have already said and lower its forecast for stock buybacks in 2016 by 25% or more, relative to the total announced in Q3 ($600bn annualized). Moreover, the buyback announcements in Q3 were already significantly lower than the first half of the year.

Secondly, investors are beginning to recognize that a high yield bond should never have traded with a 4% yield in the first place, as that yield was artificially inflated by extreme monetary policy measures such as QE. So while spreads have widened a lot, a 5% or 6% yield should really still be the equivalent of 7% or 8% similar to other cycles. Additionally, the breadth of weakness, for the first time this year, has now spread outside of the energy and materials sectors as investors do their homework on the rest of the things they own. The point here is that high yield is not cheap if the measurement is multiple cycles, not just the cycle with extraordinary monetary measures.

Finally, the other anecdotal trend we are observing is that credit traders don’t have the same appetite as equity traders to buy weakness right now. The majority of credit trader’s performance over the last few years is easily traceable to buying a new issue, watching that credit tighten immediately thereafter due to the sensational appetite for yield, and then selling them out quickly. Put another way, you are insulting equity investors when you call them IPO flippers. Right now, this trade does not exist and anyone who does not have a genuine investment process is being shut out of the market. This is one reason why credit spreads are not tightening.

The bottom line is that corporate Treasurers or credit investors remain highly suspicious of the primary issue market. Yes, companies will always need to re-finance their credit stack as part of their normal operations, as could be seen with Ford Motor paying up for it yesterday. But anything opportunistic is on hold, especially if a company has to re-model their economic projections for an M&A deal in the pipeline, as that will now come at a higher price.

So until we see several – by which we mean 3 to 4 consecutive days – of firm market tone conveying that corporate Treasurers and credit investors are once again aligned it is pretty easy to chalk up the latest move in stocks to nothing more than a classic bear market bounce. If this does not materialize, then the mindset of selling into strength will prevail.

As a reminder, when push comes to shove, you date equities but marry credit, especially after a 5-6% bounce.

Neil Azous is Founder/Managing Member of global macro think tank Rareview Macro LLC and the publisher of global macro newsletter, Sight Beyond Sight, a daily publication subscribed to by leading hedge funds and investment managers. Neil’s real-time comments and trade ideas are often posted to Twitter

To continue reading the Oct 7 edition of Sight Beyond Sight, please click the following link. Subscription is required, a Free Trial is available (no credit card required). Click here to access...