As if there were not enough electronic trading platforms, the buyside remains determined to have their own equities trading platform open only to buy-side block trading peers. MarketsMuse Tech Talk Editors tip our hats to FierceFinanceIT.com for the following update re Luminex Trading & Analytics, the ATS block trading venue backed by a consortium of large asset managers, which recently announced an updated management team in preparation for the venue’s Q4 launch.

The new management team in place is led by Jonathan Clark, former managing director and head of U.S. equities trading a BlackRock, who will serve as Luminex Trading’s CEO. Clark replaces interim CEO Michael Cashel, who will return to his position as SVP of Fidelity Trading Ventures. Plans for Clark to take over as permanent CEO were previously announced, and as of Tuesday he has officially begun the role.

Plans to build the Luminex Trading venue, which is backed by nine leading investment managers that collectively manage approximately 40 percent of U.S. fund assets, were first announced in January.

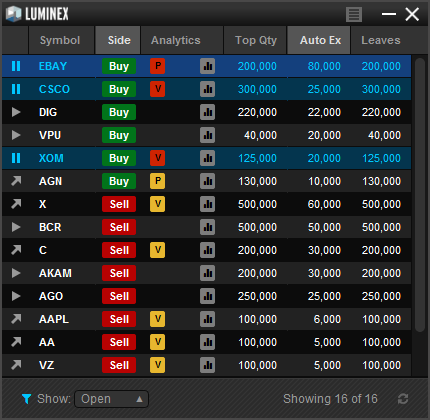

The venue will be a buy-side only block trading platform “open to any investment manager primarily focused on the long term and with the desire to trade large blocks of stock with other investment managers,” according to an earlier announcement from the company. The nine investment managers in the consortium backing Luminex are BNY Mellon, BlackRock, Capital Group, Fidelity Investments, Invesco, JPMorgan Asset Management, MFS Investment Management, State Street Global Advisors and T. Rowe Price.

Luminex Trading announced four other members of the management team this week. Brian Williamson will be head of sales, tasked with further building the client base. Williamson was previously senior global relationship manager with Liquidnet. James Dolan is chief compliance officer, joining the company from Fidelity, where he was previously vice president of compliance for Fidelity Institutional. David Hagen will head product development as Luminex Trading’s new head of product. He was previously director at Pico Quantitative Trading. David Consigli is the company’s new controller, joining from IDB Bank.

Luminex says its platform will offer investment managers lower-cost and more efficient block trading, with transparent trading rules and protocols.

Observed option market pro David Beth, the Pres/COO of institutional options and ETF broker WallachBeth Capital, ” Its good [for investors] to have more options, no pun intended. The fund industry’s limited use of the most conservative option-related strategies has always been a “head-scratcher” for those who have lived through multiple market cycles over the years and always perceived that big funds are obliged to use conservative strategies. Regardless of where one thinks the market is headed in the short or medium term, these new funds illustrate the growing recognition that systematic covered call writing can cushion downside exposure and enhance portfolio returns in both low-interest rate and stagnant market cycles; especially for funds with conservative mandates.”

Observed option market pro David Beth, the Pres/COO of institutional options and ETF broker WallachBeth Capital, ” Its good [for investors] to have more options, no pun intended. The fund industry’s limited use of the most conservative option-related strategies has always been a “head-scratcher” for those who have lived through multiple market cycles over the years and always perceived that big funds are obliged to use conservative strategies. Regardless of where one thinks the market is headed in the short or medium term, these new funds illustrate the growing recognition that systematic covered call writing can cushion downside exposure and enhance portfolio returns in both low-interest rate and stagnant market cycles; especially for funds with conservative mandates.”