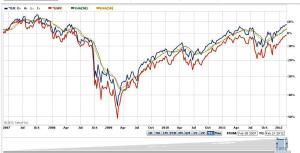

We all know that equity markets have been climbing the wall of worry for the past number of months. With both the Dow and S&P recovering to the sanguine levels not seen since the spring of 2008, covered call (buy-write) strategies within the mutual fund complex has until recently remained a relatively untapped strategy, despite the time-tested success of many fund managers who have systematically used this style of hedged investing throughout both bull and bear market cycles.

We all know that equity markets have been climbing the wall of worry for the past number of months. With both the Dow and S&P recovering to the sanguine levels not seen since the spring of 2008, covered call (buy-write) strategies within the mutual fund complex has until recently remained a relatively untapped strategy, despite the time-tested success of many fund managers who have systematically used this style of hedged investing throughout both bull and bear market cycles.

But, “the tide seems to be turning,” according to recent coverage by Peter Chapman over at Traders Magazine, who spotlights a trend change in the course of his profiling the launch of two new covered-writing closed-end funds courtesy of Mario Gabelli’s GAMCO (” GAMCO Natural Resources, Gold & Income Trust”) and John Hancock’s “Hedged Equity & Income Fund.” These are only two of the funds that are embracing a “CYA” strategy in the face of most market pundit predictions that the current upward trend is your friend, and should be expected to remain positive throughout the balance of 2012.

Whether the renewed interest in using the simplest of “hedging” strategies is attributable to percolating geopolitical concerns, or a need to enhance yield as interests rates continue to race to zero, or the growing consensus among market skeptics that what looks and sounds too good to be true often is (despite historical trends where markets typically rise into presidential elections), traders who have been around for more than 15 minutes see the resurgence of institutional option-related strategies as an approach that simply makes sense.

Observed option market pro David Beth, the Pres/COO of institutional options and ETF broker WallachBeth Capital, ” Its good [for investors] to have more options, no pun intended. The fund industry’s limited use of the most conservative option-related strategies has always been a “head-scratcher” for those who have lived through multiple market cycles over the years and always perceived that big funds are obliged to use conservative strategies. Regardless of where one thinks the market is headed in the short or medium term, these new funds illustrate the growing recognition that systematic covered call writing can cushion downside exposure and enhance portfolio returns in both low-interest rate and stagnant market cycles; especially for funds with conservative mandates.”Added Beth, “Whether its because of volatility-related concerns, or because the financial industry is populated by a new generation of professional fund managers who have the benefit of hindsight, we’re now noticing an uptick in interest from RIA-centric and other institutional clients who appreciate that buy-writing, which is simply selling exchange-traded call options against an underlying long position (whether single stock, ETF or index) can certainly enhance Alpha, as long as the execution approach is well thought out. That said, taking this approach one step further by also incorporating put-oriented strategies can help a manager sleep better at night knowing that his investors’ portfolios have an added degree of crisis protection in a world dominated by 24/7 news cycles.”

Observed option market pro David Beth, the Pres/COO of institutional options and ETF broker WallachBeth Capital, ” Its good [for investors] to have more options, no pun intended. The fund industry’s limited use of the most conservative option-related strategies has always been a “head-scratcher” for those who have lived through multiple market cycles over the years and always perceived that big funds are obliged to use conservative strategies. Regardless of where one thinks the market is headed in the short or medium term, these new funds illustrate the growing recognition that systematic covered call writing can cushion downside exposure and enhance portfolio returns in both low-interest rate and stagnant market cycles; especially for funds with conservative mandates.”Added Beth, “Whether its because of volatility-related concerns, or because the financial industry is populated by a new generation of professional fund managers who have the benefit of hindsight, we’re now noticing an uptick in interest from RIA-centric and other institutional clients who appreciate that buy-writing, which is simply selling exchange-traded call options against an underlying long position (whether single stock, ETF or index) can certainly enhance Alpha, as long as the execution approach is well thought out. That said, taking this approach one step further by also incorporating put-oriented strategies can help a manager sleep better at night knowing that his investors’ portfolios have an added degree of crisis protection in a world dominated by 24/7 news cycles.”

Not everything about buy-writing may be perfect, however. In referencing the performance of Invesco’s PowerSharesS&P 500 BuyWrite Portfolio, Chapman’s coverage points to what some see as a pervasive concern of fund managers who may be mitigating the wider use of buy-writing; “Despite the passive nature of the fund, Invesco still managed to underperform its benchmark in its most recent fiscal year. The CBOE index returned 8.8 percent in the year ended April 30, 2011. The Invesco fund returned 7.8 percent. Fund managers, in their annual report, blamed “relatively wide option bid-ask spreads” for the gap.”

Beth’s response to ‘the wide [screen-based] bid-ask’ complaint is straight-forward: “One has to accept the fact that screen-based markets are myopic. The further out [in time], the displayed liquidity is necessarily going to diminish, simply because no rationale person is going to broadcast aggressively-priced bids or offers that will commit them to significant risk on a long-dated basis. But, that doesn’t mean there isn’t ample liquidity out there, its just not advertised on a screen. This is why traditional, liquidity sourcing and aggregating approaches are integral to the execution process.”