MarketsMuse blog update is courtesy of BrokerDealer.com and initial reporting by InvestmentNews.com and profiles the deal between RIA titan Envestnet and mutual fund king Eaton Vance, which is now approved to promote its novel, actively-managed ETF product “NextShares.” NextShares are exchange-traded funds that are both actively managed and unlike any other ETF product, does not disclose the underlying components of the respective ETFs. These products now go by the acronym “ETMFs.”

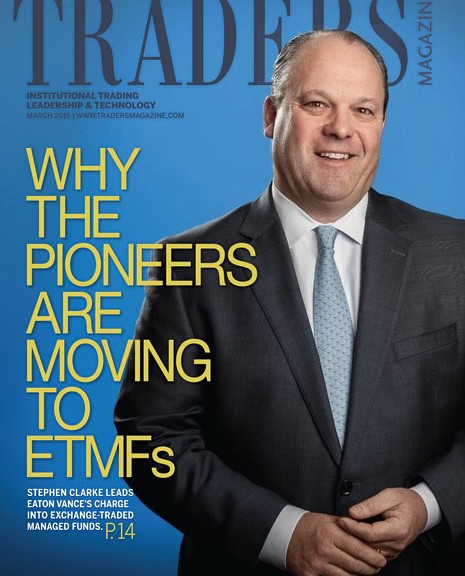

Since its approval, Eaton Vance has had to work hard to convince competitive money managers to license its patent and persuade broker-dealers that it is in their interest to make NextShares available to advisers even though the funds don’t offer the same underlying fees to encourage distributors. Eaton Vance’s NextShares-promoting subsidiary, Navigate Fund Solutions, has had to make that case before it even has a product on the market or a distribution partner.

BrokerDealer.com provides a global directory of regulated securities industry professionals operating in 30 major countries across the free world.

The deal is a big win for Eaton Vance, an actively managed mutual fund company that’s hoping to replace those products with a potentially more tax-efficient vehicle that could lower costs and improve performance for investors. Envestnet is a major gatekeeper in the fast-growing market of independent financial advisers, providing services for over $700 billion in client assets.

In a statement, an Envestnet executive, Jim Patrick, described NextShares as a “groundbreaking fund structure” and said the company sees offering the funds as part of its mission to help advisers deliver “wealth management services in the most cost- and tax-efficient way possible.”

ONLY APPROVED PRODUCT

NextShares was the first and remains the only structure approved by the Securities and Exchange Commission that allows an actively managed open-end fund to trade on exchanges without regularly disclosing its holdings. Portfolio managers resist showing the securities they buy and sell, in part to prevent being taken advantage of by competitors.

– See more at: BrokerDealer.com

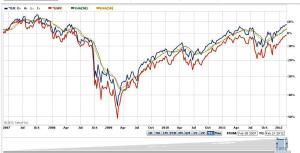

Observed option market pro David Beth, the Pres/COO of institutional options and ETF broker WallachBeth Capital, ” Its good [for investors] to have more options, no pun intended. The fund industry’s limited use of the most conservative option-related strategies has always been a “head-scratcher” for those who have lived through multiple market cycles over the years and always perceived that big funds are obliged to use conservative strategies. Regardless of where one thinks the market is headed in the short or medium term, these new funds illustrate the growing recognition that systematic covered call writing can cushion downside exposure and enhance portfolio returns in both low-interest rate and stagnant market cycles; especially for funds with conservative mandates.”

Observed option market pro David Beth, the Pres/COO of institutional options and ETF broker WallachBeth Capital, ” Its good [for investors] to have more options, no pun intended. The fund industry’s limited use of the most conservative option-related strategies has always been a “head-scratcher” for those who have lived through multiple market cycles over the years and always perceived that big funds are obliged to use conservative strategies. Regardless of where one thinks the market is headed in the short or medium term, these new funds illustrate the growing recognition that systematic covered call writing can cushion downside exposure and enhance portfolio returns in both low-interest rate and stagnant market cycles; especially for funds with conservative mandates.”