MiFID II Implementation Triggers Flow of $50b into Europe ETF Market In First Weeks of 2018; ETF Sec Lending and ETF Options Growth Expected to Drive EU Financial Markets.

“What we’ve seen for the first time in European ETF trading is really a concerted interest in trading ETF options in Europe. A load of clients use ETF options in the States, but in 2018 — and it’s a culmination of MiFID II (and other factors) — I think there is an acceptance that this is now a practical and attractive proposal for people who want to trade volatility, buy protection or raise income by selling options. That’s really unlocking a whole new dimension in the way end-investors can use ETFs,”

Twenty-five years ago, when SPDR, the original Exchange-Traded Fund (ETF) was christened on the American Stock Exchange with the nickname “Spiders”, this MarketsMuse senior curator was one of the first market-makers on the Amex to trade the ‘new-fangled’ product. Along with a cadre of other professional traders and floor brokers from that time, we’re now viewed as the original cast of The ETF Story. A quarter of a century later, ETFs represent $3trillion in assets; a number that some expect to double in size in just a few more years. Across the US financial market ecosystem, the ETF evolution has transformed investment strategy schemes on the part of retail and institutional investors within the context of equity, fixed income, commodities and derivatives market investment styles. And with the January 2018 implementation of The Markets in Financial Instruments Directive II (MiFID II), few will dispute that Europe is on the cusp of realizing a massive asset allocation transformation to ETF constructs, as the benefits to investors and industry participants cannot be understated.

“Best execution and post-trade transparency are two areas where MiFID II seems to have had an impact on ETF trading,” said Slawomir Rzeszotko, head of institutional sales and trading, Europe, at quantitative trading firm, global liquidity provider and market maker Jane Street Group LLC in London. “In both cases, the changes appear to have encouraged institutional investors to execute more trades via (request for quote platforms).”

For those who are still unclear as to the value proposition of utilizing exchange-traded funds, let us the count the ways, starting with the ability to deploy assets based on investment theme (e.g. industry or index of specific types of stocks or bonds) via an instrument that trades just like a stock in terms of transparency, liquidity and low cost commissions. There’s a host of reasons why retail investors are generally better served to use ETFs vs. Mutual Funds. Let’s not overlook Warren Buffett’s view that index investing is a smarter approach for individual investors. For institutional investors, the list of reasons to embrace ETFs has become equally compelling. We won’t provide a tutorial if you haven’t gotten the memo yet, we’ll simply point you to the text book explanation. It’s taken a long time for institutional investors in the U.S. to ‘get the joke’, now its time for European ETF Issuers to ramp up the education and awareness process aimed at institutional investors. Here’s a few hints as to how MiFID II implementation is going to benefit those charged with overseeing institutional portfolios, pension assets and end retail clients:

- Greater Transparency (which delivers Greater Liquidity)

- Lower Cost to Execute (vs mutual funds)

- Ability to allocate to specific themes

- Portfolio Transition Ease

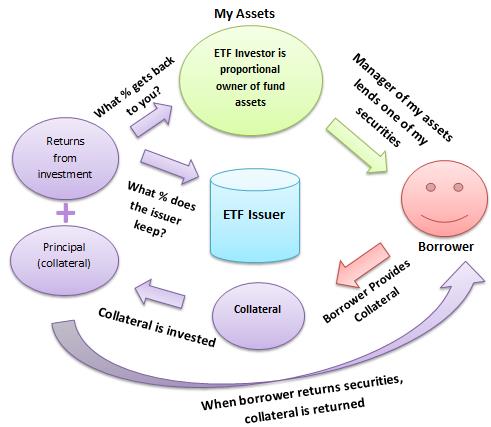

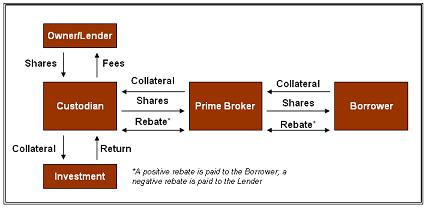

- Securities Lending (Sec Lending) Opportunities (more income to funds that hold ETFs)

- Introduction of Options on ETFs–to enable hedging and portfolio optimization schemes.

“When volumes and trading hit a certain critical point, the acceptability of any of those things that trade as collateral becomes more feasible.” The look-through liquidity afforded by the MiFID II rules means “we’re at a tipping point where ETFs themselves are being recognized increasingly as something that can be used in the world of lending. It means the borrow market in ETFs in Europe is moving toward where it is in the States.. A good “borrow” or securities lending market also lends itself to a “functional options market..”

We’ll leave the lengthier explanation to P&I’s Sophie Baker–who put forth a superb dissertation in the Feb 19 2018 edition of Pensions & Investments Magazine titled “Europe in line for ETF boom, thanks to MiFID II”. MarketsMuse ETF curators also extends a big shout out to “Dame Deborah Fuhr”, who is viewed by most across ETF land as the “Queen of ETFs”. Her Eminence Dame Deborah is an industry icon and founder of research platform and industry think tank ETFGI. When it comes to objectively framing the ETF value proposition within the European theater, nobody does it better–so we think you should follow her on Twitter.

If you’ve got a hot insider tip, a bright idea, or if you’d like to get visibility for your brand through MarketsMuse via subliminal content marketing, advertorial, blatant shout-out, spotlight article, news release etc., please reach out to our Senior Editor or email: cmo@marketsmuse.com.