MarketsMuse curators are often most inspired by views expressed by those dedicated to interpreting and positing financial market outlooks via a global macro lens. This ‘style’ requires a disciplined process and for those who are best in the practice of this dark art, the projections are often prescient. With that, we point to opening commentary courtesy of global macro guru Neil Azous via ‘Special Sunday Night Edition’ of “Sight Beyond Sight”, a daily publication produced by global macro think tank, Rareview Macro LLC and one that is followed by many of the top hedge funds across the globe.

The majority of conversations over the weekend were centered on the breakdown in the momentum factor in US equities. Given how deeply embedded this factor is into all strategies built over the last 18-months, the tentacles are far reaching, including observations on the value versus growth style, large versus small capitalization, quantitative strategies, the performance of TMT funds, defensive rotation, etc.

Since this newsletter is forward-looking – sight beyond sight – we will not rehash those conversations or illustrate the back-tests of past episodes of momentum unwinds that have been published.

However, there are a few important observations to recognize.

Firstly, the world’s most sought after top-down strategists are united in calling for the momentum unwind to continue. In fact, some were quick to begin to take victory laps on their forecasts for this event so the last thing they want to do is relinquish their trophies so soon. At this point, vanity is all that is left for some even if their broken clock is right twice per day.

Secondly, a lot of ink has been spilled over the last six months on the narrow market leadership – FANG, NOSH, Top 10 basket, Top 20 basket, etc. We highlight this because unlike the sell-off in January that was driven by hedging and index futures flows this sell-off is being driven by the long selling in the narrow leadership – single stocks – which makes up a disproportionate amount (i.e. 40-45%) of the S&P 500’s market capitalization. Put another way, there is no hedge to this type of selling except to reduce risk outright.

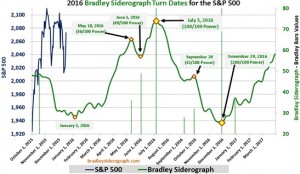

Thirdly, there are a lot of kids with rulers out there drawing straight lines on a chart. In fact, we did not even have to data mine very hard at all to find key breaks in many relationships. While these illustrations are subjective depending upon what technical analysis discipline you subscribe to, the fact is that for the moment they are self-fulling to the momentum unwind narrative and you have to live with them for a while. We have included a few for your amusement in the Top Observation section below.

In our experience, there are two types of momentum unwind.

The first one is the normal run-of-the-mill unwind due to irrational exuberance in valuations and an extended positioning in consensus strategies.

The second one is related to changes in cycles.

It is a bad combination when all three – valuations, positioning, and cycles – converge as is the case now, in our opinion.

Regardless of which bucket you want to place the current episode into, the reality is that these exercises tend to last 2-3 months, and in some cases when the world is really in bad shape, as many currently feel it is, can last 6-months or longer.

The key point here is that to expect a resumption of momentum or a recovery of that factor’s leadership this early in the unwind, especially considering the PnL duress in the professional community is currently more violent than the losses suffered in January, would be misguided.

Put another way, if there is a momentum strategy, style relationship, market capitalization, sector rotation, you watch daily, and it is down or has reversed by 5-10%, call us when it is down or has reversed by 20-30%, and we will take a look at it.

Finally, ask yourself this question:

If the EURO STOXX 50 Index (SX5E), German DAX (DAX), NASDAQ 100 (NDX), Russell 2000 (RTY), and Facebook-Amazon-Netflix-Google (FANG) all made new “closing lows” for 2016 last Friday, then is it more likely that the next move for global risk assets is a bounce or that the Nikkei 225 (NKY) and S&P 500 (SPX) will play catch up?

The answer to that question, along with other insights can be found by those who read the entire Sunday Night Special Editor of Sight Beyond Sight. To do so, please go directly to Rareview Macro’s archive section via this link (Subscription Required, but Free Trial Subscriptions are still being offered)