MarketsMuse coverage of the exchange-traded fund (ETF) industry began nearly ten years ago, and our senior curators have since been scratching their heads as to why CNBC, the retail investors’ most-watched business news network had never created dedicated programming to educate their viewers about ETFs, an asset class that has consistently grown (by as much as 20% YoY). How big is this market? Based on various metrics published by the assortment of ETF Issuers, more than $3 Trillion (with a “T”) of ETFs are held by US investors, the global market size is over $5 Trillion (with a “T”).

More telling, RIAs (Registered Investment Advisors) that manage money for retail investors now allocate well more than 50% of client money into these thematic funds. That said, CNBC–the business media channel that has become ubiquitous for its retail investor-targeted 12 hour+ daily coverage of stock market activity, interviews with fund managers, sell-side research analysts and public company CEOs have provided merely tangential insight to the ETF marketplace. Until now, that is.

Yesterday, CNBC premiered a new segment titled “ETF Edge” and hosted by commentator Bob Pisani. The premiere segment captured two particularly insightful ETF industry veterans; hedge fund manager Tim Seymour (who is also one of CNBC’s frequent market commentators) and Andy McCormond, Managing Director of ETF Execution for agency broker-dealer WallachBeth Capital, a boutique institutional brokerage whose thought-leadership on the topic of ETFs and better approaches to executing orders in ETF products has been embraced by a discrete universe of institutional investors and tens of dozens of RIAs for more than 10 years.

Hats Off to CNBC for shedding more light on an asset class that retail investors need to know more about. Roll the opening show clip!

ETF Edge, January 23, 2019 from CNBC.

If you’ve got a hot insider tip, a bright idea, or if you’d like to get visibility for your brand through MarketsMuse via subliminal content marketing, advertorial, blatant shout-out, spotlight article, news release etc., please reach out to our Senior Editor via cmo@marketsmuse.com

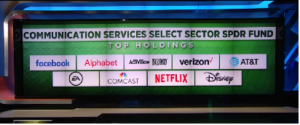

Wow. That’s a bucket full of precision when considering the constituents of XLC include among others, Facebook (NYSE:FB), Alphabet Inc (

Wow. That’s a bucket full of precision when considering the constituents of XLC include among others, Facebook (NYSE:FB), Alphabet Inc (

The buy side is becoming more targeted with sell-side firms, employing a rifle rather than a shotgun approach as liquidity continues to shrink. A big factor behind this newfound independence has been the lessening of liquidity in 2014 in derivatives and fixed income markets, which has forced buy-side institutions to be more resourceful in sourcing liquidity

The buy side is becoming more targeted with sell-side firms, employing a rifle rather than a shotgun approach as liquidity continues to shrink. A big factor behind this newfound independence has been the lessening of liquidity in 2014 in derivatives and fixed income markets, which has forced buy-side institutions to be more resourceful in sourcing liquidity

nnection with the 1st Annual ETF Awards hosted by ETF.com, the world’s leading authority on exchange-traded funds, agency execution firm

nnection with the 1st Annual ETF Awards hosted by ETF.com, the world’s leading authority on exchange-traded funds, agency execution firm  Take-away from (2) news articles today profiling proliferation of algorithmic trading strategies: The buyside “gets it”, but they don’t want it..

Take-away from (2) news articles today profiling proliferation of algorithmic trading strategies: The buyside “gets it”, but they don’t want it..