MarketsMuse Strike Price section spots news that BATS Global has received approval from the Securities and Exchange Commission to open its second options trading venue, EDGX Options. Launch of the EDGX Options system is tentatively set for Monday, November 2, BATS said.

The actual SEC Approval Order from the SEC can be found here.

As reported by Traders Magazine, EDGX Options will be based on a customer priority/pro rata allocation model and is designed to complement its BZX Options market, the exchange operator’s first U.S. options market which had a 10.8% market share in July, and one that is a “pure” price-time priority market. The launch of EDGX Options will enable BATS to compete for a new segment of order flow that does not trade on the price-time markets that BATS currently operates.

“We are pleased to receive approval from the SEC to launch EDGX Options and we are looking forward to making our mark in a new segment of the options market,” said Bryan Harkins, executive vice president and head of U.S. Markets at BATS. “Two-thirds of U.S. options market volume is executed on exchanges with a pro rata model and we believe we can help make markets better for participants in this segment of the market through our innovative technology, operating efficiency, market-leading pricing, and first-class customer service.”

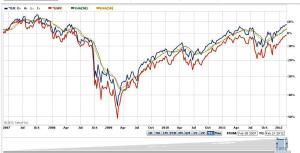

Observed option market pro David Beth, the Pres/COO of institutional options and ETF broker WallachBeth Capital, ” Its good [for investors] to have more options, no pun intended. The fund industry’s limited use of the most conservative option-related strategies has always been a “head-scratcher” for those who have lived through multiple market cycles over the years and always perceived that big funds are obliged to use conservative strategies. Regardless of where one thinks the market is headed in the short or medium term, these new funds illustrate the growing recognition that systematic covered call writing can cushion downside exposure and enhance portfolio returns in both low-interest rate and stagnant market cycles; especially for funds with conservative mandates.”

Observed option market pro David Beth, the Pres/COO of institutional options and ETF broker WallachBeth Capital, ” Its good [for investors] to have more options, no pun intended. The fund industry’s limited use of the most conservative option-related strategies has always been a “head-scratcher” for those who have lived through multiple market cycles over the years and always perceived that big funds are obliged to use conservative strategies. Regardless of where one thinks the market is headed in the short or medium term, these new funds illustrate the growing recognition that systematic covered call writing can cushion downside exposure and enhance portfolio returns in both low-interest rate and stagnant market cycles; especially for funds with conservative mandates.”