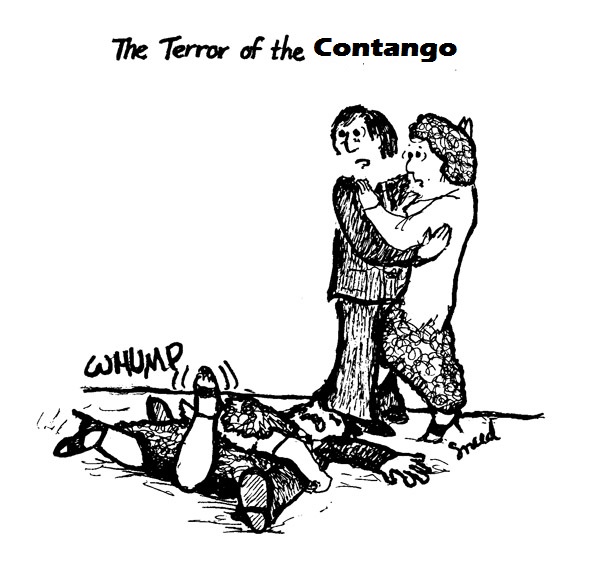

For those who are confused as to the near-term, or even longer-term price direction of Oil, even J.R. Ewing would tell you there isn’t an oil man in Texas, including Boone Pickens, who can see far beyond the prices posted at the pump. Especially when one gas station in Oklahoma is now selling one gallon for .99 –a price that has been seen in certain spots, but not since 1993 has oil been so ‘cheap.’ For those who try to express a bet on price direction via a financial instrument, one leading markets muse is going so far as to infer that “..Only idiots use the ETF $USO to make a bet with.” Why? It Can’t Tango! Well…that’s perhaps a poetic license pun on words, but..

Courtesy of the universally-known ETF Professor Todd Shriber, who pens for financial news site Benzinga, the markets muse in question turns out to be one of the global macro world’s more eloquent and most thoughtful gurus.. Here’s the extract from Shriber’s early a.m. column:

To say the United States Oil Fund LP (ETF) (NYSE: USO), which tracks West Texas Intermediate crude oil futures, is a flawed product is accurate and fair. Over the past three years, USO is down 77.1 percent, but the exchange-traded product remains a favorite, on both sides of the oil trade, of professional traders.

Inflows to USO confirm as much. After adding nearly $3.1 billion in new assets last year, USO has seen year-to-date inflows of almost $900 million. USO’s 2016 inflows put it just outside of the year’s top 10 asset-gathering ETFs.

USO And Contango

Perhaps the greatest source of criticism against USO comes from the fact that the ETF is frequently in contango. As it pertains to USO, contango occurs when the West Texas intermediate futures currently held by the ETF trade at higher prices than the market expects that contract to trade at for the months ahead.

“Oil traders should be aware that USO tracks front-month WTI future contracts and the underlying oil market is currently in a state of contango. Consequently, USO could experience a negative roll yield when rolling a maturing futures contract, or selling a contract that is about to expire in exchange for the next month contract,” according to ETF Trends.

WTI And Negative Yield Rolls

Speaking of negative yield roll, West Texas Intermediate futures are currently facing an epic negative yield roll.

“The widening in the ‘contango’ between the first and second futures contracts, or the March-April spread (CLH6-CLJ6), has exploded to ~8 percent in negative roll yield,” said Rareview Macro founder Neil Azous in a note out Wednesday evening.

As Azous noted, West Texas Intermediate’s current level of contango is quadruple that of Brent crude, the global oil benchmark contract, on a percentage basis.

The problem for any trader, professional or retail, who is long USO is that instances of exaggerated West Texas Intermediate have previously given way to savage declines for that contract and USO.

“The extrapolation that the market will likely make into next week’s crude oil futures roll and options expiration is that the next leg lower in the barrel has started and this CLH6-CLJ6 spread can widen out dramatically as evidenced by the extreme widening to 25 percent back in the winter of 2008-2009 when the barrel finally bottomed out for that cycle,” added Azous.

.

.