For readers focused on expert views re: the precious metals, and in particular Gold, below a.m. note courtesy of macro-themed analyst Paul Krake to his “View From The Peak” audience of institutional investment managers provides a “bid-on” to market observations made last week by Neil Azous, principal of “bespoke macro strategy boutique” Rareview Macro LLC, and the publisher of “Sight Beyond Sight” :

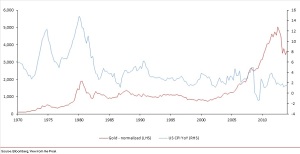

“..Short gold has been one constant theme for VFTP for the past 18 months and I do not see any reason to adjust this structural stance. The reasons to be short gold are long and varied but they all go back to my basic theme that as the world becomes less risky, the need for safe haven assets declines. If real interest rates are on the rise then gold will decline. A more sophisticated thesis is being proposed by my good friend Neil Azous from Rareview Macro, an extremely thoughtful and thorough daily overview of the investment landscape (www.rareviewmacro.com). Neil’s argument revolves around a revitalized global capex cycle that will be driven by a spurt in bank lending and the global economy playing catch up after five years of underinvestment across the developed world. We have this expressed via our long energy (XLE) / short consumer discretionary (XLY) basket but short gold is also an excellent expression of what will be the end result of this recalibration of the capex cycle: higher global growth and higher real interest rates…”

Paul Krake’s observations are available via http://www.viewfromthepeak.com.hk/.

The “Sight Beyond Sight” newsletter authored by Neil Azous is distributed to leading investment managers, Tier 1 hedge funds and top gun traders across the universe of sell-side, cash trading desks. Additional info at www.sightbeyondsight.com