Corporate Bonds and exchange-traded funds is a combination that first seemed counter-intuitive to the select universe of traders who are actually fluent in both corporate bond trading and equity trading; two practice areas that are distinctively different. “Stocks are bought and bonds are sold” as they used to say, and…Read More

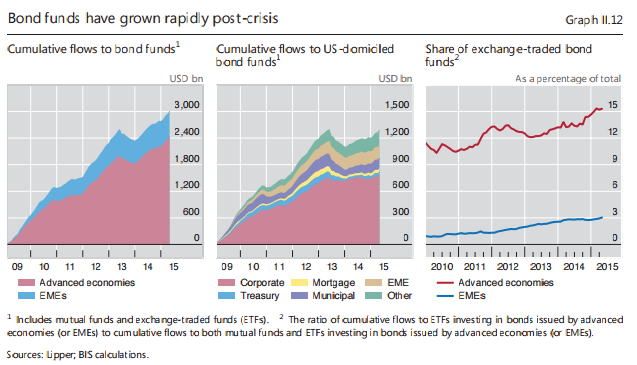

MarketsMuse ETF and Fixed Income curators have frequently spotlighted the ongoing debates as to whether corporate bond ETFs, and in particular, junk bond-specific exchange-traded-funds pose special risks. Some argue that a liquidity crisis could unravel the high yield bond sector if/when institutional investors decide that risk of recession continues to…Read More

Referring to anyone as 'being impaired' is not a compliment. And, in the world of financial market punditry, where at least half of the experts are best at telling their audience what happened during the past 12 hours, while another 45% who position themselves as forecasters are right maybe 50%…Read More

Fixed Income trading platform TradeWeb, best known for its dominant role administering OTC government securities trading between global banks and institutional customers is muscling into the world of ETFs. Tradeweb has just launched an electronic over-the-counter marketplace for trading exchange traded funds using a "request-for-quote" aka "RFQ"- based platform that…Read More

MarketsMuse curators have canvassed assortment of guru-types who have attempted to decipher Friday's stock rally, along with tuning in to the abundance of Monday morning quarterback views. For those who turn to the cartoon channel (i.e. CNBC), some pundits call it a dead cat bounce, more optimistic professional traders and…Read More

MarketsMuse fintech and fixed income curators are both noticing increasing upticks in stories relating to the use of blockchain technology specifically for use within the corporate bond issuance process. We might have been one of the first to focus on this application despite the early stage push back from IT…Read More

Announced after the close of trading on Thursday, Goldman Sachs $5.1 billion settlement with the U.S. Department of Justice, AGs from NY and IL and two other federal agencies in connection with the big bank's underwriting and sale of mortgage-backed securities (MBS) sounds whopping, but seemed to have little impact…Read More

To kick off the 2016 debt market outlook, MarketsMuse fixed income curators are looking forward to the next Caribbean boondoggle, and in that spirit, we extend a shout out to Ron Quigley, one of the primary debt capital market's top pulse-takers who also goes by the title Head of Fixed Income Syndicate…Read More

You don't need to be a MarketsMuse or a global macro guru (or any other type of pundit) to know that professional financial market traders are only as good as their last best trade. In that spirit, we look to the 2016 outlook and spotlight on the Wrong Way First…Read More

Marathon Asset Management CEO Bruce Richards Leads Crowdfund Campaign for "Veterans Education Challenge" Hedge Fund Honcho Will Match $1mm Raised via Crowdfunding Platform CrowdRise (RaiseMoney.com) For those Wall Street sharks and finance industry wonks who haven’t yet received the memo about crowdfunding, you might want to dial in to hedge…Read More

MarketsMuse followers have been reminded more than a few times that conventional wisdom requires investors to keep their eyes on corporate bond spreads so as to have a clear lens when considering the outlook for equity prices on a medium-to-longer time frame. The relationship between high-yield debt,most-often measured by HYG…Read More

9 November (BrokerDealer.com)--Broker-Dealer Mischler Financial Group (“Mischler”) , the securities industry’s oldest minority investment bank and institutional brokerage owned and operated by Service-Disabled Veterans announced that in connection with the firm’s annual recognition of Veteran’s Day, Mischler has pledged a portion of the firm’s entire November 2015 profits to The…Read More

Guest Contributor and fixed income markets muse Ron Quigley, Managing Director of Fixed Income Syndicate for diversity firm Mischler Financial Group offers a Glass of Insight to the likely timing of the ABBIB acquisition of SABLN (AnheuserBusch proposed takeover of brewer SAB Miller). Below commentary is an extract from 15…Read More

While 99% of market pundits have been busy for the past months laying odds and making bets as to precisely when and how much the Fed will raise interest rates, a small universe of Fed Watchers have picked up on a surprising nuance that few seasoned market experts have even…Read More

MarketsMuse extends a warm salute to the nation's oldest and largest minority brokerdealer owned and operated by service-disabled military veterans in connection with the following news announcement.. Oct 5 2015–Stamford, CT and Newport Beach CA–Mischler Financial Group, Inc., the financial industry’s oldest and largest institutional brokerage and investment bank owned…Read More

"To put it bluntly, what headline writers or traders are selling you today is a load of bollocks." Neil Azous, Rareview Macro LLC When global macro guru Neil Azous of Rareview Macro appeared on CNBC midday yesterday, MarketsMuse curators had already absorbed and relayed his recent views about energy prices,…Read More

Professional Investment Community Cries Out in Agony and They Don’t Yet Know Exactly Why MarketsMuse Strike Price and Global Macro curators voted the Oct 5 edition of global macro advisory firm Rareview Macro's Sight Beyond Sight the best read of the week. Yes, its only Monday, but those who follow…Read More

MarketsMuse Fixed Income Update "Corporate Bond Market- Balancing on a Knife Edge" is courtesy of extract from the 10.02.15 weekend edition of "Quigley's Corner", a daily synopsis of the investment grade corporate bond market and rates trading space authored by Ron Quigley, Managing Director of investment bank and institutional brokerage…Read More