Veteran-Owned Minority Broker-Dealer Mischler Financial Group Makes 2016 Veterans Day Month Pledge Courtesy of MarketsMedia - Stamford, CT & Newport Beach, CA –Veterans Day is observed by Americans each year on November 11; the day that is dedicated to honoring and extending our gratitude to the millions of men and…Read More

Nobody can accuse veteran government bond market broker and fintech poster boy David Rutter of being single-minded. The former Prebon Yamane exec, who later migrated to inter-dealer broker ICAP where he became of head of electronic trading, then did a stint as CEO of fixed income and FX platform BrokerTec,…Read More

The Fed is Fed Up re Rates Talk...or at least they must be, according to MarketsMuse pundits who have frequently guessed wrong within the context of how much and when the FOMC will decide to upend the current interest rate regime and return to normal. Below excerpt is courtesy of…Read More

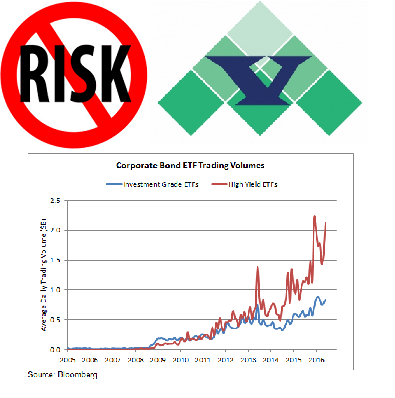

Virtu Says NO to Corporate Bond ETF risk-taking; Top Market-Maker Opines “Unable to Hedge ETF Constituents Due To Limited Liqudity” During the better part of three years, MarketsMuse Fixed Income curators have often pointed to concerns expressed by market professionals who argue that the unfettered growth of corporate bond ETFs…Read More

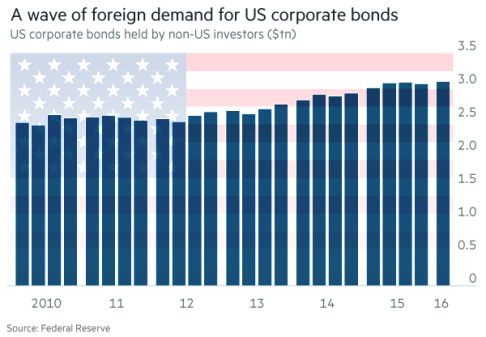

MarketsMuse Fixed Income Curators have been keeping tabs on the seemingly insatiable and outsize demand for yield and in particular, the demand for IG Corporate Bonds aka investment grade corporate debt. With that, we roll to opening excerpt of Aug 9 notes from "Quigley's Corner", the financial industry award-winning commentary…Read More

Private Placement Services Portal Changes Name to PPM.co; Adds Full Suite of Product Offerings with Launch of New Website (PRweb)--New York, NY--July 12 2016- PPM Services, Ltd, the global consulting firm specialising in private placement memorandum document preparation for debt and equities and business plan preparation services for start-ups,…Read More

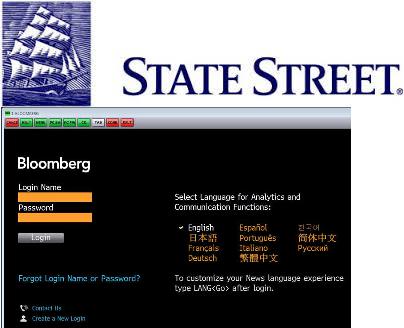

Now that corporate bond fund managers have proven their continuing interest in and use of bond ETFs, State Street and Bloomberg LP are joining hands in an effort to re-define the notion of "straight-thru-processing" for institutional investors that are using fixed income ETF products...MarketsMuse sends a shout-out to BusinessWire for…Read More

BREXIT or BREMAIN the NEVERENDUMS Will Continue in Europe "Should I Stay or Should I Go? That Answer Is Self Evident..." A Global Macro perspective from Debt Market Veteran..Music by Clash, Comments by Quigley Below excerpt courtesy of 22 June edition of "Quigley's Corner", the industry award-winning debt capital market…Read More

May 12-Stamford, CT--Mischler Financial Group (“MFG”), the financial industry’s oldest minority investment bank and institutional brokerage owned and operated by Service-Disabled Veterans, announced today that in recognition of the upcoming Memorial Day celebration, the firm has pledged a percentage of its entire May profits to Veterans Education Challenge, (VetEdChallenge) a donation-based…Read More

Below extract is courtesy of May 09 edition of daily debt capital market commentary and focus on investment grade corporate debt deals courtesy of boutique investment bank Mischler Financial Group, the financial industry's oldest minority broker-dealer owned and operated by Service-Disabled Veterans. MarketsMuse editorial team adds: "Make no mistake, the…Read More

(FinanceMagnates.com) Supporters of Tom Hayes, the former UBS rates trader and the first person to be convicted for the manipulation of the London Interbank Offered Rate (LIBOR), have launched a crowdfunding appeal via UK platform Fundrazr to raise £150,000 ($217,403) to underwrite a further appeal against his conviction. The former…Read More

The high-frequency arms race, aka "Battle Between Wall Street-style Transformers" has extended to trading in USTs and HFT firms are invading the US Treasury market, according to latest from BusinessInsider.. (BusinessInsider)-High-frequency traders have taken over the market for US Treasuries, and a bunch of market participants say they're alarmed by the…Read More

Start-up corporate bond trading system OpenBondX is hoping to pull a rabbit out of its hat and jump start activity by emulating what the universe of equities-centric electronic exchanges and ATS platforms do in order to attract order flow to their respective venues: pay broker-dealers for orders given to them…Read More

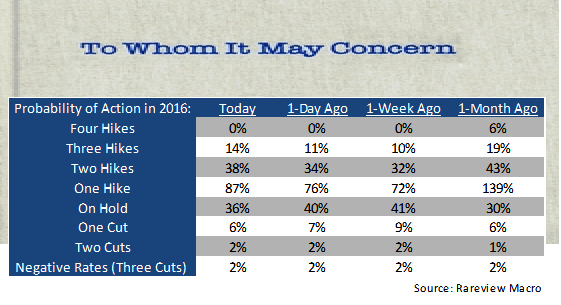

Memo: To Whom It May Concern: Inflation Risk is Back In Play Below is a special edition of global macro commentary courtesy of Stamford-based think tank Rareview Macro LLC, the publisher of "Sight Beyond Sight." The following has been excerpted by the curators at MarketsMuse and republished with permission from…Read More

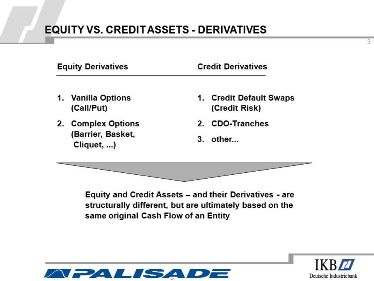

Violent price swings across financial markets this year have forced corporate bond investors to re-evaluate their portfolio allocations, and subsequently, their hedging strategies. Diminishing liquidity in credit-default swaps has led many traders to delve into equity options. (TABB Group) by columnist Callie Bost- Imagine you’re a corporate-bond trader and the…Read More

On the heels of this past week’s near record-breaking investment grade corporate debt issuance courtesy of multiple Fortune companies who are seizing the moment insofar as the current low rate regime, Toyota Motor Credit Corp (TMCC), the financing arm of the world’s largest car maker did something different yesterday in…Read More

BNY Mellon 'Gets It' and Also Gives It Back. With close-on $29Trillion in deposits and $1.3Trillion in AUM, BNY Mellon (NYSE:BK), the oldest bank in the U.S. is not just the country's biggest, it ranks as one of the world's biggest banks. Hundreds of financial industry professionals now working across…Read More

If not as widely-covered as the GOP or DNC primaries, financial industry publication Wall Street Letter ("WSL") held its 5th Annual Institutional Trading Awards ceremony last night at NYC venue 583 Park Avenue and recognized best-in-class broker-dealers across 7 major categories, including Best Broker Dealer (OverAll), Best Broker-Dealer Research, Best…Read More