Many fixed income folks are lamenting about liquidity in the corporate bond market. LiquidNet, the institutional trading platform is determined to make corporate bond trading more liquid..for the buyside. Just when you thought e-bond trading for corporate bonds was a never ending pipe dream... Liquidnet Launches Fixed Income Dark Pool…Read More

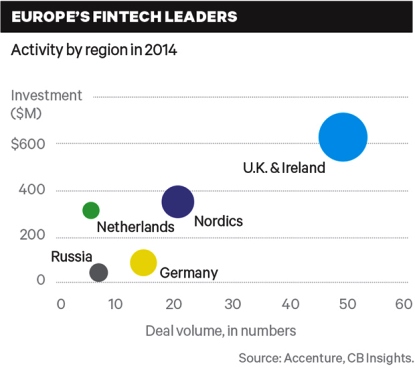

The FinTech aka financial technology revolution continues to advance across the financial industry landscape, as dozens of startups from block chain to bond trading initiatives work towards securing a presence within the institutional financial services ecosystem. And, as profiled in a brilliant column this week from Institutional Investor spotlighted by…Read More

MarketsMuse news curators have spotted dozens of commentaries from leading equities and debt market pundits opining about global mining giant Glencore. There is only one comment that offered a truly rare view that struck a chord, and it is courtesy of this morning's edition of global macro newsletter "Sight Beyond…Read More

For Wall Street bankers and brokers who have been in the business since at least the early 2000's and are still working on the Street, and who think you've already been pilloried plenty for the work you do, watch out, former Lehman broker-turned best-selling author Michael Lewis ("Liar's Poker", "Money…Read More

MarketsMuse editors were relieved yesterday after the Fed announcement for two reasons; the first being we were reminded that at least half of Wall Street's Fed-watching pundits who get paid big bucks to predict events can be replaced by anyone who can flip a coin, as half of the pundits…Read More

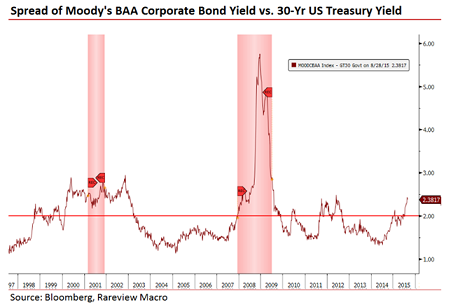

Most sophisticated investors, whether Tier 1 institutional investment managers, 'top minds' across the sell-side, or the truly savvy, self-directed types should all agree that fixed income market signals, and investment grade credit spreads in particular are a prelude to what equities market can expect to happen. Whether the 'lag time'…Read More

In the wake of recent weeks' volatility and pricing dislocations across the exchanged-traded product space, news media and Mutual Fund marketers are having a field day putting the feet to the fire--and those toes being torched are connected to the universe of juiced-up and levered ETF and ETN products, as…Read More

For RIAs who want to be smarter (and at the same time, earn CFP and CE credits, MarketsMuse points you to the Sept 17, Forbes Advisor Playbook iConference. Why? Well for one, Shark Tank shark extraordinaire Kevin O'Reilly a newbie ETF Issuer of exchanged-traded funds firm "O'Shares" (whose first product…Read More

One needs to have 'been there and seen that' for at least twenty years in order to have been "loaded for bear" in advance of this morning's equities market rout. At least one of the folks who MarketsMuse has profiled during the past many months meets that profile; and those…Read More

Bond giant Pacific Investment Management Co. aka Pimco said Monday that it received a Wells Notice from the SEC and the firm could be sued by the country’s top securities regulator over how it valued assets in ETF $BOND, one of its most popular exchange-traded bond funds aimed at small…Read More

Within the context of continuous guessing as to the outlook for a rate hike, and how to hedge fixed income portfolios accordingly, getting a strong fix on fixed income strategies has proven to be a challenge for a vast majority of professional investors during the past 24-26 months, many of…Read More

MarketsMuse Global Macro and Fixed Income desks converge to share extract from 23 July edition of Rareview Macro commentary via its newsletter "Sight Beyond Sight". For those not following the corporate bond market, most experts will tell you the equities markets follow the bond market--which in turn is a historical…Read More

Introducing electronic trading to the corporate bond culture is not easy. Fintech initiatives have been trying to crack this egg for 20 years, each promoting the theory that enhanced transparency via electronic trading leads to enhanced corporate bond market liquidity, and ultimately, a robust marketplace for institutional traders to traffic…Read More

MarketsMuse Fixed Income Dept. is keeping tabs on industry updates and re-distributes the following news release courtesy of Mischler Financial Group, the financial industry's leading minority brokerdealer owned and operated by service-disabled veterans. Stamford, CT—July 22, 2015—Mischler Financial Group, Inc., the financial industry’s oldest and largest minority investment bank and…Read More

As the events in Greece escalate to a frenzy, global macro strategists are lining up to opine on what might happen as the EU and the world calculate the impact of a Grexit. MarketsMuse tapped into one of the industry's most thoughtful strategists and one who is notorious for having…Read More

MarketsMuse editors are almost starting to lose count when it comes to the number of electronic trading initiatives from FinTech aficionados who purportedly intend to make the institutional corporate bond market more transparent, and hence more liquid.. Thanks to Liquidnet, the latest player to plug into the corporate bond market…Read More

MarketsMuse ETF update courtesy of FundsEurope.com profiles French asset management firm Lyxor, and their plan to launch a China government bond exchange-traded fund (ETF) in Europe. The firm has been awarded a licence on the S&P China Sovereign Bond 1-10 Year Spread Adjusted Index by S&P Dow Jones Indices (SPDJI).…Read More

BrokerDealer Gives Back and Pays It Forward; Mischler Financial’s "Memorial Day Month" Pledge Yields $20k for Semper Fi Fund. MarketsMuse is honored to be the first financial industry news outlet to report an inspiring story that profiles thought-leadership on the part of boutique brokerdealer, Mischler Financial Group and their financial…Read More