MarketsMuse editors are almost starting to lose count when it comes to the number of electronic trading initiatives from FinTech aficionados who purportedly intend to make the institutional corporate bond market more transparent, and hence more liquid..

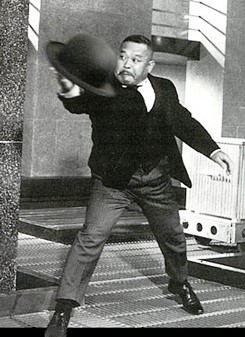

Thanks to Liquidnet, the latest player to plug into the corporate bond market movement and throw their hat into the ring, there are now 15 (give or take) initiatives. We can only opine that those who believe that fragmenting marketplaces [particularly products that were never even centralized to start with] as a means to creating a competitive, transparent and hence liquid trading marketplace for institutional investors is at very best, counterintuitive. Some market structure experts might even go so far as to say this electronic bond free-for-all for market share is “completely assbackwards.”

Per coverage by Pensions & Investments Magazine, institutional trading network Liquidnet is set to launch an institutional dark pool for corporate bonds, in the third quarter this year. Best known as a dark pool provider for institutional equities trading, Liquidnet is integrating seven order management systems, which execute securities orders, to provide the connectivity and access to trading opportunities that are not currently available in the corporate bonds market. Liquidnet said in a news release Thursday the development will centralize “a critical mass” of corporate bond liquidity to market participants.

“By connecting to (clients’) existing order management systems, asset managers will have direct access to a protected venue that allows them to exchange natural liquidity with minimum effort and minimum information leakage,” said Constantinos Antoniades, head of Liquidnet fixed income, in the news release. “The functionality, protocols and connectivity of our dark pool will create significant new liquidity in the broader corporate bond universe — not just in the most liquid segment of the market.”

“By connecting to (clients’) existing order management systems, asset managers will have direct access to a protected venue that allows them to exchange natural liquidity with minimum effort and minimum information leakage,” said Constantinos Antoniades, head of Liquidnet fixed income, in the news release. “The functionality, protocols and connectivity of our dark pool will create significant new liquidity in the broader corporate bond universe — not just in the most liquid segment of the market.”

Upon reading the press release via Pensions & Investments Magazine, one electronic market veteran had this to say, “The long-held thesis that a centralized marketplace, where all orders are routed and displayed in centralized limit order books (CLOBS) is the best foundation to attracting liquidity and by definition, also provides true best execution for legacy OTC products is a notion that seems to have gone with the wind.” Added that Opinionator (who chooses to remain anonymous given his current Industry role), “It’s only mildly surprising that the regulators (i.e. SEC) have no clue as to the impact of their enabling an industry-wide gambit that will turn the corporate bond market into an electronic rats nest. Despite a 5-fold increase in outstanding issuance during the past several years, Dodd-Frank regulation has caused banks to step away from traditional market-making and risk taking, and consequently, the corporate bond market is only becoming increasingly more illiquid. More electronic platforms approved by regulators will simply make the corporate bond market even more fragmented and even less competitive.”