In effort to thwart the “Catch Me If You Can” crowd, the SEC has proposed a new audit system that will purportedly allow regulators to track every bid and offer submitted to stock and options exchanges in effort to catch market manipulators.

(WSJ)–U.S. market regulators on Wednesday proposed a massive data repository that will eventually allow them to sift through billions of daily trading records to detect market manipulation and probe bouts of extreme market disruption.

The Securities and Exchange Commission’s consolidated audit trail will,enable regulators to track 58 billion daily transactions submitted to stock and options exchanges, as well as private-trading venues maintained by brokerage firms. Plans for the CAT, as it is called, were spurred by the May 6, 2010, flash crash, when more than 20,000 trades were executed at clearly erroneous prices and nearly $1 trillion in equity-market value was wiped out before prices rebounded.

The project has taken years to get off the ground, as industry groups have disagreed over its scope, costs and governance. Regulators believe the system will become a powerful means of quickly investigating excessive volatility and could be harnessed for other purposes, such as detecting insider trading and whether brokers are getting the best price for their clients.

“This will help us to fully understand the trading that is occurring in our markets within a matter of days, instead of months,” SEC Commissioner Kara Stein said at a meeting where the agency unanimously approved the plan. “The need for the CAT has unfortunately been proven over and over again.”

According to one market structure expert who spoke with MarketsMuse, “Another intriguing idea brought forth by a bureaucracy that has proven it has no fluency in technology and no real ability to implement policy that might infringe on the interests of Wall Street. They’ll be talking about this pipe dream for another four years, then spend 3x the amount budgeted and then discover the system is flawed.”

The proposal also sets several deadlines to ensure the system is fully operational within four years. The SEC must take final action to approve the CAT within six months. Exchanges would have to begin reporting trading data to the system by late 2017. Large brokers would have to comply by 2018, and small brokers would have until 2019 to report their activity.

Regulators still have to choose who will build the system, a decision that could come late this year or early in 2017. A selection committee has narrowed the choice to three bidders—the Financial Industry Regulatory Authority, Fidelity National Information Services Inc. unit SunGard and Thesys Technologies LLC.

The project’s supporters say it would have been useful last August, when huge price swings triggered more than 1,000 trading halts in stocks and exchange-traded products. It took the SEC nearly six months to issue a paper explaining the factors that influenced the barrage of trading halts on Aug. 24.

For the full story from the WSJ, click here

Yet an upstart fund manager called

Yet an upstart fund manager called

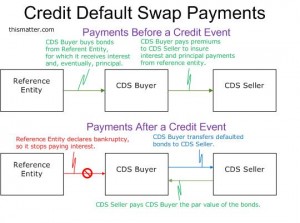

Traditionally, CDSs have been the favored hedge for corporate bond portfolios. However, regulatory restrictions and capital requirements for US banks stemming from the Basel III accords have crimped their ability to deal over-the-counter (OTC) credit derivatives. And several other rules and restrictions have further limited these banks from operating as traditional providers of liquidity and immediacy in the over-the-counter market.

Traditionally, CDSs have been the favored hedge for corporate bond portfolios. However, regulatory restrictions and capital requirements for US banks stemming from the Basel III accords have crimped their ability to deal over-the-counter (OTC) credit derivatives. And several other rules and restrictions have further limited these banks from operating as traditional providers of liquidity and immediacy in the over-the-counter market.