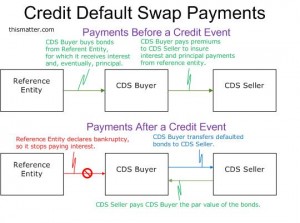

Violent price swings across financial markets this year have forced corporate bond investors to re-evaluate their portfolio allocations, and subsequently, their hedging strategies. Diminishing liquidity in credit-default swaps has led many traders to delve into equity options.

(TABB Group) by columnist Callie Bost– Imagine you’re a corporate-bond trader and the world is falling apart around you. Your portfolio’s bonds are in freefall and you desperately need to cap your losses. Can you trust traditional credit hedges to come through for you in times of distress? Will you be able to purchase or redeem protection when you desperately need to stay solvent?

Many fixed income investors have run through the same thought process when deciding how to hedge their portfolios. However, the choice to use traditional fixed-income hedges over other instruments hasn’t been so obvious recently.

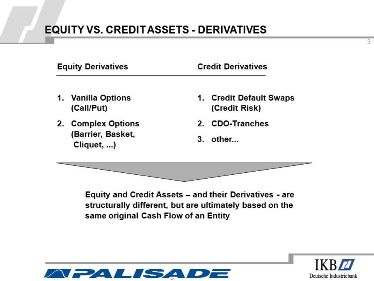

As banks continue to adapt to regulatory initiatives designed to rein in balance sheet risk, liquidity in CDS markets will continue to dwindle. While the decline of the CDS markets is a grim story for banks and dealers, it has been a beneficial shift for options market participants.

Traditionally, CDSs have been the favored hedge for corporate bond portfolios. However, regulatory restrictions and capital requirements for US banks stemming from the Basel III accords have crimped their ability to deal over-the-counter (OTC) credit derivatives. And several other rules and restrictions have further limited these banks from operating as traditional providers of liquidity and immediacy in the over-the-counter market.

Traditionally, CDSs have been the favored hedge for corporate bond portfolios. However, regulatory restrictions and capital requirements for US banks stemming from the Basel III accords have crimped their ability to deal over-the-counter (OTC) credit derivatives. And several other rules and restrictions have further limited these banks from operating as traditional providers of liquidity and immediacy in the over-the-counter market.

To continue reading, please click here