When it comes to gauging best execution, that exercise is akin to a game of whack-a-mole when calculating in the role of wholesalers aka over-the-counter market-makers whose business model includes leveraging maker-taker rebate schemes. MarketsMuse credits below excerpted observations from TabbForum and courtesy of Stanislav Dolgopolov, Decimus Capital Markets, LLC

(TabbForum) Compliance with the duty of best execution is typically focused on customer-facing brokers, but the stringent standard of best execution may pop up several times in the transactional chain. One critical issue already getting—and deserving—more attention is the extent to which the duty of best execution applies to off-exchange market makers, commonly referred to as ‘wholesalers’ or ‘internalizers,’ and whether conflicts of interest are keeping them from meeting these obligations.

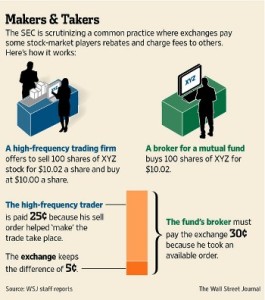

One illustration of potential conflicts of interest is monetization of maker-taker arrangements for certain types of orders – typically, nonmarketable limit orders – by off-exchange market makers through secondary routing, which may potentially come at the expense of execution quality, given that a substantial portion of orders directed to them consists of such orders. Furthermore, a typical major player in the wholesaling segment is in the spotlight to demonstrate the adequacy of execution within its affiliated dark pool(s), given a bevy of concerns, such as toxicity, slowness, or leakages of customer order information. Yet another consideration from the standpoint of the very definition of “best execution” is whether there are self-interested or otherwise avoidable delays counter to the requirement of prompt execution.

Finger-pointing in connection with achieving and maintaining execution quality is not necessarily an easy task. Compliance with the duty of best execution is typically focused on customer-facing brokers, as illustrated by the level of scrutiny of retail brokerages, including lawsuits, in connection with payment for order flow and maker-taker arrangements. At the same time, the stringent standard of best execution may pop up several times in the transactional chain. One critical issue already getting—and deserving—more attention is the extent to which the duty of best execution applies to off-exchange market makers, commonly referred to as “wholesalers” or “internalizers.”

This assumption of the duty of best execution may be rooted in contractual arrangements—sometimes called “order handling agreements”—between off-exchange market makers and customer-facing brokerage firms. Pursuant to the applicable agreement, an off-exchange market maker may in fact discharge agency-based functions in addition to trading in the principal capacity. By contrast, market making on securities exchanges has been “de-agentized” in the sense that designated market makers have been relieved of their traditional agent-like duties to investors. In fact, some order handling agreements specifically mention the best execution standard. Even when this standard is not spelled out, the scope of the applicable relationship is likely to bind that off-exchange market maker as a true “executing broker” subject to the duty of best execution.

To read the entire article, please click here

Excerpt courtesy of April 15 edition of WSJ and reporters Scott Patterson and Andrew Ackerman.

Excerpt courtesy of April 15 edition of WSJ and reporters Scott Patterson and Andrew Ackerman.