MarketsMuse senior editors have quickly canvassed a broad assortment of "market structure experts" and industry talking heads who have been at the forefront of debating the pros and cons of market electronification, multiple market centers and the underlying issue: "Is Market Fragmentation Good, Bad or Ugly?" For those who might…Read More

MarketMuse update courtesy of Anna Bernasek 9 January article in The New York Times. JUDGING solely by the name, stock trading in so-called dark pools may conjure up images of mysterious deals cut beyond public view. Also called simply “dark trading,” it happens when computers serve as matchmakers and bid-and-ask…Read More

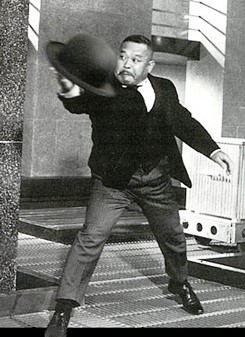

For those who might have missed it, Jeffrey Sprecher (pictured above), the CEO of Intercontinental Exchange, which owns the NYSE, is determined to put the genie back in the bottle by turning back the market structure changes that have taken place over the past 10 years, including the surge of…Read More

NYSE CEO Says "Not Good" while appearing before Senate on the topic of equities market structure and Maker-Taker Rebate Schemes. Bowing to increasing pressure from regulators, law makers and law enforcement officials, Finra, the securities industry "watchdog" has launched its own probe into how retail brokers route customer orders to…Read More

MarketsMuse Editor Note: Though we typically focus on using a high-touch approach to aggregating the more topical and poignant ETF, Options and Macro-Strategy news items, the nearly never-ceasing diatribes re market structure and the impact of "high-frequency trading" which has either been incited or simply elevated by Michael Lewis's…Read More

For those who missed the MarketsMuse memo from Jan 14, there appears to be yet another exchange coming to the US Equities markets, as if the industry needs one more platform to facilitate trading in publicly-listed stocks. The latest platform, which is still on the whiteboard, is a consortium-based initiative…Read More

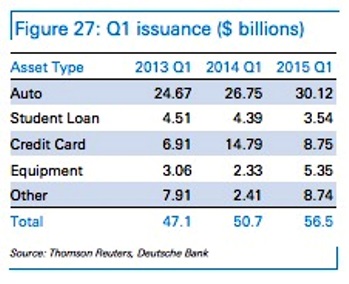

Corporate Bond Market Transparency 4.0 MarketsMuse fixed income fintech curators, who have been on the beat for better than 8 years, were keen to cover this week's inaugrual meeting of FIMSAC. e-Bond trading system founders, fixed income fund managers and fintech aficionados who have long lamented the limited degree of US…Read More

For exchange-based specialists, prop floor traders and upstairs sell-side market-makers, the notion of buy-side traders putting on the hat of risk-taking market-making is a head scratcher. Sure, there's a cadre of hedge fund wonks who have interned on a sell-side trading desk, then moved up to Greenwich to grab a…Read More

In effort to thwart the "Catch Me If You Can" crowd, the SEC has proposed a new audit system that will purportedly allow regulators to track every bid and offer submitted to stock and options exchanges in effort to catch market manipulators. (WSJ)--U.S. market regulators on Wednesday proposed a massive data repository…Read More

On the heels of an Oct 6 story at MarketsMuse about UK-based "Crowd2Fund.com", now there's another fintech entrant seeking to introduce secondary market trading of crowdfund deals. In a news release this week, Australia's Equitise is joining with Syndex to create a new Alternative Trading System (ATS) to facilitate secondary…Read More

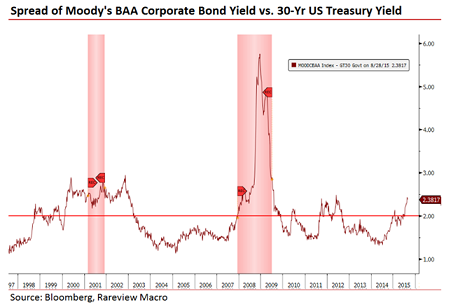

Most sophisticated investors, whether Tier 1 institutional investment managers, 'top minds' across the sell-side, or the truly savvy, self-directed types should all agree that fixed income market signals, and investment grade credit spreads in particular are a prelude to what equities market can expect to happen. Whether the 'lag time'…Read More

MarketsMuse Global Macro and Fixed Income desks converge to share extract from 23 July edition of Rareview Macro commentary via its newsletter "Sight Beyond Sight". For those not following the corporate bond market, most experts will tell you the equities markets follow the bond market--which in turn is a historical…Read More

MarketsMuse Fixed Income Dept. is keeping tabs on industry updates and re-distributes the following news release courtesy of Mischler Financial Group, the financial industry's leading minority brokerdealer owned and operated by service-disabled veterans. Stamford, CT—July 22, 2015—Mischler Financial Group, Inc., the financial industry’s oldest and largest minority investment bank and…Read More

MarketsMuse editors are almost starting to lose count when it comes to the number of electronic trading initiatives from FinTech aficionados who purportedly intend to make the institutional corporate bond market more transparent, and hence more liquid.. Thanks to Liquidnet, the latest player to plug into the corporate bond market…Read More

MarketsMuse.com ETF update shines light on Pakistan, as the timing of the launch of the first Pakistan-focused exchange-traded fund in the U.S. is remarkably fortuitous. U.S.-based ETF provider Global-X is launching the ETF today on the New York Stock Exchange with ticker symbol NYSE:PAK. Below extract courtesy of WSJ Frontiers…Read More

MarketsMuse.com ETF update is pleased to share an informative perspective about best practices and “best execution” that institutional investment managers, RIAs and others should consider when using ETFs, courtesy of insight from one of the more widely respected members of ETF “agency-only” execution space. Here’s the excerpt of the ETFdb.com…Read More

MarketsMuse.com Options market update focuses on recent industry report canvassing the perch of buyside managers perspective as to the good, the bad and the ugly sell-side broker elements they encounter in the course of increasing use of listed options products is courtesy of recent report issued by industry think tank,…Read More

MarketsMuse options market coverage of MIAX, the latest entrant to the continuously fragmented world of securities exchanges is courtesy of Traders Magazine Options industry market makers, Citadel Securities LLC, KCG Americas LLC, Morgan Stanley & Co. LLC, Optiver US LLC, Susquehanna Securities, Timber Hill LLC, and Wolverine Trading, LLC have…Read More