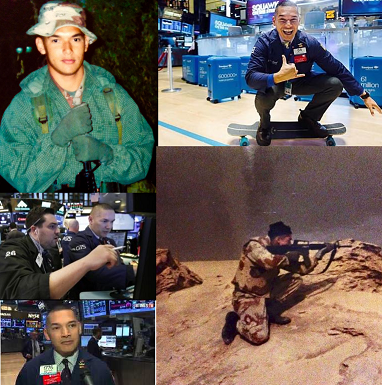

US Marine veteran of Operation Just Cause and Operation Desert Storm and veteran NYSE floor trader enlists with designated market-maker GTS with rank of Global Market Commentator

From the USMC to the NYSE, Mark Otto re-defines the phrase ‘veteran’ when considering his pedigree as a highly-decorated former US Marine and the 25 years of financial industry service he’s racked up since hanging up his gun belt. Former Marine Corporal Otto saw combat throughout his 4 years as an enlisted solider (first 1989 Panama Invasion “Operation Just Cause”and thereafter, Operation Desert Storm and then parachuted into the line of fire on the global financial industry’s most iconic battle field: the trading floor of the New York Stock Exchange. After three tours of duty serving under the commands of NYSE floor specialists Susquehanna Group, Knight Capital and J. Streicher, Otto will now be serving under a new command, he’s just signed on with the veteran-friendly NYSE Designated Market-Maker, GTS where Otto will have the rank Global Market Commentator. In November, GTS announced they had secured a minority stake in veteran-owned investment bank and institutional brokerage, Mischler Financial Group

Excerpt from the Jan 17 ,2019 press release is below:

NEW YORK–(BUSINESS WIRE)–GTS, a leading electronic market maker across global financial instruments, today announced the addition of U.S. Marine Corps combat veteran and experienced equities trader Mark Otto as the firm’s first Global Market Commentator.

As Global Market Commentator for GTS, Otto will combine his specialty of trading American depositary receipts (“ADR”), algorithmic trading, market making and volatility trading with his experience trading in times of historic geopolitical events and market turmoil such as the 2008 Financial Crisis, the Flash Crash, the Greek Debt Crisis, Eurozone Debt Crisis and Brexit to provide market commentary on current trends and their impact on the securities markets.

“I am thrilled to continue my career on the NYSE with GTS,” Mark Otto said, “So much of the pricing of stocks results from international developments and interconnected global economies. It’s an honor for me to share my commentary and views as part of the GTS platform. The firm is a pioneer in bringing innovation to the marketplace and it is an incredible opportunity for me to be teaming up with such an important player in the global capital markets ecosystem.”

Between 1988 and 1992, Otto served under the 2nd Surveillance Renaissance and Intelligence Group based out of Camp Lejeune, North Carolina. During his military service, Otto saw combat during the Panama Invasion and Operation Desert Storm, as well as leading surveillance teams observing and securing U.S. boarders in support of Federal Law Enforcement agencies. Otto received over a dozen military decorations and achievements, including the Combat Action Ribbon with Gold Star, Joint Meritorious Unit Commendation and Airborne Jump Wings.

GTS is the largest Designated Market Maker (“DMM”) at the New York Stock Exchange (“NYSE”) and has an extensive track record of responsibly using best-of-class technology to bring better price discovery, trade execution and transparency to the markets. At the NYSE, GTS is responsible for the trading in more than 900 public companies that have a total market capitalization of approximately $13 trillion dollars. Listed securities include blue chip companies ranging from ExxonMobil (NYSE: XOM) and Ford (NYSE: F) to international companies such as Alibaba (NYSE: BABA) to leading global technology companies like Oracle (NYSE: ORCL) and AT&T (NYSE: T).

If you’ve got a hot insider tip, a bright idea, or if you’d like to get visibility for your brand through MarketsMuse via subliminal content marketing, advertorial, blatant shout-out, spotlight article, news release etc., please reach out to our Senior Editor via cmo@marketsmuse.com

To read the full press release, click here