MarketsMuse.com ETF update is courtesy of extract from 15 April Zacks.com article published at SeekingAlpha.com

Despite endless economic and financial woes, as well as geopolitical tensions in the Middle East, Israeli stocks have been on the rise and are clearly outperforming its neighboring countries and the broad world market.

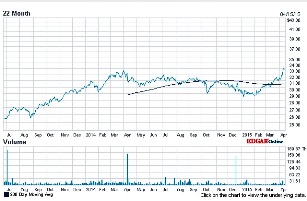

This is particularly true given that the iShares MSCI Israel Capped ETF (NYSEARCA:EIS) and the Market Vectors Israel ETF (NYSEARCA:ISRA) have gained in double digits so far this year. This is compared to the gains of 3.9% for WisdomTree Middle East Dividend ETF (NASDAQ:GULF), 6.3% for the SPDR S&P Emerging Middle East & Africa ETF (NYSEARCA:GAF), 5.2% for the iShares MSCI ACWI Index ETF (NASDAQ:ACWI) and 2.6% for the SPDR S&P 500 Trust ETF (NYSEARCA:SPY).

The strong gains came from the easing policies adopted by the Bank of Israel (BOI) to guard against the recent appreciation of the shekel and pull the country out of deflation. The BOI surprisingly reduced its interest rate by 15 bps to a record low of 0.10% in February that will likely boost economic growth and the inflation rate to 1-3% within a year, while maintaining financial stability. The bank could introduce further measures, matching Europe to stimulate growth in the economy, if required.

Israel remains one of the stable countries in the Middle East amid endless territorial disputes and security concerns. The country’s economy has proven to be quite resilient and strong compared to those of its neighboring nations. Israel is the dominant leader in technological innovation, which is pulling solid capital into the country. Continue reading