MarketsMuse.com ETF update is courtesy of extract from 15 April Zacks.com article published at SeekingAlpha.com

Despite endless economic and financial woes, as well as geopolitical tensions in the Middle East, Israeli stocks have been on the rise and are clearly outperforming its neighboring countries and the broad world market.

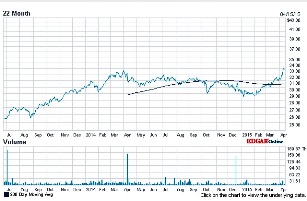

This is particularly true given that the iShares MSCI Israel Capped ETF (NYSEARCA:EIS) and the Market Vectors Israel ETF (NYSEARCA:ISRA) have gained in double digits so far this year. This is compared to the gains of 3.9% for WisdomTree Middle East Dividend ETF (NASDAQ:GULF), 6.3% for the SPDR S&P Emerging Middle East & Africa ETF (NYSEARCA:GAF), 5.2% for the iShares MSCI ACWI Index ETF (NASDAQ:ACWI) and 2.6% for the SPDR S&P 500 Trust ETF (NYSEARCA:SPY).

The strong gains came from the easing policies adopted by the Bank of Israel (BOI) to guard against the recent appreciation of the shekel and pull the country out of deflation. The BOI surprisingly reduced its interest rate by 15 bps to a record low of 0.10% in February that will likely boost economic growth and the inflation rate to 1-3% within a year, while maintaining financial stability. The bank could introduce further measures, matching Europe to stimulate growth in the economy, if required.

Israel remains one of the stable countries in the Middle East amid endless territorial disputes and security concerns. The country’s economy has proven to be quite resilient and strong compared to those of its neighboring nations. Israel is the dominant leader in technological innovation, which is pulling solid capital into the country.

In addition, Israel has one of the lowest unemployment rates in the developed world, that fell from 6.2% in 2013 to 5.9% in 2014. Moreover, low fiscal deficit, solid private consumption growth, higher exports, and the victory of Prime Minister Binyamin Netanyahu added to the strength of the economy.

However, deflationary fears and appreciation of the Israeli currency have been the major risk to its economic growth. The economy expanded at the slowest pace of 2.6% in five years last year, and inflation dropped 0.7% in February, marking a six consecutive months’ decline. Tension is forever high in Israel due to the dispute with the Palestinian Authority and conflicts in its neighboring countries – Lebanon, Syria and Iran.

EIS in Focus

This fund tracks the MSCI Israel Capped Investable Market Index, and holds 54 securities in its basket. It is heavily concentrated on the top firm – TEVA – accounting for about one-fourth of the portfolio, while other firms hold no more than 8.9% share. Further, financials take the top spot from a sector look, at 36.5%, closely followed by healthcare (25.2%) and materials (9.2%).

The fund has amassed $104.3 million in its asset base, and trades in a light volume of around 39,000 shares a day, on average. It charges 62 bps in fees per year from investors.

ISRA in Focus

This ETF tracks the BlueStar Israel Global Index, and holds 120 securities in its basket. It is highly concentrated on the top two firms – TEVA and PRGO – which make up over 12% of shares each. Other firms account for less than 6.5% of total assets. From a sector look, information technology and healthcare occupy the top two positions, with 33.5% and 31.9% share, respectively, while financials round off the top three, taking a double-digit allocation in the fund’s portfolio.

Though the fund provides exposure to the Israeli market, U.S. firms account for nearly 30.2% share, and the United Kingdom also makes up a small portion. The ETF has AUM of $46.1 million, while the average daily volume is paltry at about 6,000 shares. The expense ratio came in at 0.59%.

For the entire article at SeekingAlpha, please click here