MarketsMuse curators are often most inspired by views expressed by those dedicated to interpreting and positing financial market outlooks via a global macro lens. This 'style' requires a disciplined process and for those who are best in the practice of this dark art, the projections are often prescient. With that,…Read More

Referring to anyone as 'being impaired' is not a compliment. And, in the world of financial market punditry, where at least half of the experts are best at telling their audience what happened during the past 12 hours, while another 45% who position themselves as forecasters are right maybe 50%…Read More

MarketsMuse curators have canvassed assortment of guru-types who have attempted to decipher Friday's stock rally, along with tuning in to the abundance of Monday morning quarterback views. For those who turn to the cartoon channel (i.e. CNBC), some pundits call it a dead cat bounce, more optimistic professional traders and…Read More

(SubstantiveResearch.com). Trading oil or simply just talking about where, when and why this commodity will assert a more predictable pricing direction has proven to be a slippery slope for professionals and pundits alike. Expressing views via the actual barrel (WTI) or via an ETF (e.g. USO, BNO etc) has been…Read More

(SubstantiveResearch.com) Neil Azous from Rareview Macro writes that many in the market still don’t get the joke of what’s going on – that is, a true exercise in risk reduction led by real money or that the bears are in charge. Indeed, he observes much of communications he and his…Read More

To kick off the 2016 debt market outlook, MarketsMuse fixed income curators are looking forward to the next Caribbean boondoggle, and in that spirit, we extend a shout out to Ron Quigley, one of the primary debt capital market's top pulse-takers who also goes by the title Head of Fixed Income Syndicate…Read More

You don't need to be a MarketsMuse or a global macro guru (or any other type of pundit) to know that professional financial market traders are only as good as their last best trade. In that spirit, we look to the 2016 outlook and spotlight on the Wrong Way First…Read More

(Bloomberg) -- A European stock trade that deployed the use of ETF products as a means of hedging currency exposure is one that enamored global investors throughout 2015 and drew more money than practically anything else in equities is blowing up in people’s faces. As the moves in the the WisdomTree…Read More

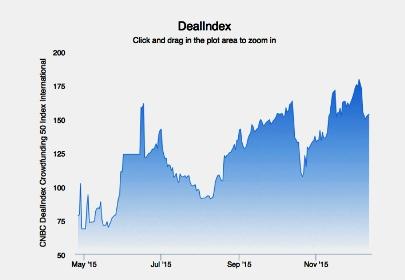

(RaiseMoney.com) The Equity Crowdfund Industry continues to go mainstream, as evidenced by this week's market data and index intel pact signed between business news platform CNBC and DealIndex, a self-described “global deal and data aggregator for the best crowdfunding opportunities.” The deal will have the two firms launching four equity…Read More

(MarketsMedia) European ETFs and ETPs have gathered record net new assets in the first 11 months of this year, in many cases using as a displace to futures products. ETF Issuer BlackRock expects the size of Europe's exchange-traded product market to double over the next three to four years. ETFs/ETPs listed…Read More

The Big Short is coming to a theater near you soon, but the hedge fund industry's cool kid of the year David Miller has traded ahead of his peers by exploiting and being short of the popular ETF industry product: leveraged ETFs and “inverse ETFs”; products that are typically powered…Read More

MarketsMuse Global Macro curators, like many across the hedge fund complex, have attempted to decipher an investment thesis that can prove itself without being hijacked by short-term volatility. Deflation, Inflation, Oil, the Dollar and bets being made in advance of the Fed's widely-expected interest rate adjustment are talking point ingredients…Read More

MarketsMuse Global Macro curators credited with metaphoric title "Dollars and Donuts"--a phrase many of those who trade on institutional desks should appreciate...Snippet below is courtesy of a.m. edition of institutional research unbundler SubstantiveResearch.com Neil Azous from Rareview Macro writes that for all attention being devoted to the equity market at…Read More

Weekend's Geopolitical Events Are Being Ignored.. MarketsMuse curators have been navigating commentary across the media throughout the weekend in search for the various financial industry pundits and opinionators who might add some context to the terrorism that shook Paris on Friday night. No surprise, we noticed the below opening from…Read More

Marathon Asset Management CEO Bruce Richards Leads Crowdfund Campaign for "Veterans Education Challenge" Hedge Fund Honcho Will Match $1mm Raised via Crowdfunding Platform CrowdRise (RaiseMoney.com) For those Wall Street sharks and finance industry wonks who haven’t yet received the memo about crowdfunding, you might want to dial in to hedge…Read More

9 November (BrokerDealer.com)--Broker-Dealer Mischler Financial Group (“Mischler”) , the securities industry’s oldest minority investment bank and institutional brokerage owned and operated by Service-Disabled Veterans announced that in connection with the firm’s annual recognition of Veteran’s Day, Mischler has pledged a portion of the firm’s entire November 2015 profits to The…Read More

While 99% of market pundits have been busy for the past months laying odds and making bets as to precisely when and how much the Fed will raise interest rates, a small universe of Fed Watchers have picked up on a surprising nuance that few seasoned market experts have even…Read More

"To put it bluntly, what headline writers or traders are selling you today is a load of bollocks." Neil Azous, Rareview Macro LLC When global macro guru Neil Azous of Rareview Macro appeared on CNBC midday yesterday, MarketsMuse curators had already absorbed and relayed his recent views about energy prices,…Read More