Administrative oversight left BlackRock unable to meet demand for its Gold ETF, IAU; Suspends New Issuance.

(WSJ) –BlackRock Inc. said it suspended the issuance of new shares in IAU, its roughly $7.7 billion gold exchange-traded product due to an administrative oversight, in the latest bruise for the exchange-traded-fund industry and its largest provider.

Analysts said the move on Friday threatens to drive business to competitors and intensify scrutiny of the $2 trillion ETF business in the U.S. It also underscores concerns that these products—baskets of assets that trade intraday like stocks—are vulnerable to breakdowns.

Friday’s suspension came after a 20% run-up this year in the price of gold. The rally had spurred increased demand for the iShares Gold Trust, which is traded on the New York Stock Exchange under ticker symbol IAU. Some analysts said the surge in gold-futures prices likely drove up demand for the product for use both in bets that gold would rise and bets that it would fall. Those wagers came amid uncertainty over the health of the global economy and concerns about resilience of the financial system in the face of negative interest rates in Europe and Japan.

BlackRock wasn’t able to issue new shares to meet the demand because it failed to file the appropriate Securities and Exchange Commission paperwork, the firm said.

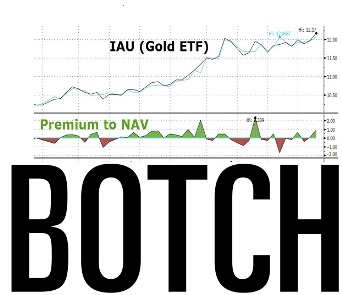

The breakdown could prevent the fund from accurately reflecting the value of gold, interrupting a key process that lets investors arbitrage any difference between the quoted price of the ETF and the value of the underlying assets.

The suspension could mean the price of the fund would rise faster than the price of gold until share creation resumes. Investors are “going to be paying more of a markup,” said Mohit Bajaj, director of ETF trading at WallachBeth Capital LLC, which trades iShares Gold Trust. “I think people are going to be trading GLD instead of IAU now,” he said, referring to the ticker symbol for SPDR Gold Trust, which is run by a unit of the World Gold Council and marketed by State Street Corp.

In the week ended Thursday, investors put more than $1.1 billion into the iShares product’s key rival, the about $32 billion SPDR Gold Trust, more than any other exchange-traded product, according to FactSet data.

For the full story from WSJ, please click here