Contango is Back

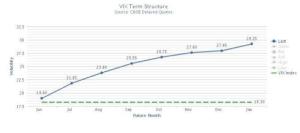

The volatility futures curve is back in strong contango, and with it an opportunity to profit from the short trade on volatility linked ETFs/ETNs. For a primer on this trade, see previous articles here and here, but in short it’s an attempt to profit from the bias of investors to believe that market volatility in the future will be greater than it is in the present – essentially a fear of the “unknown unknowns”.

A Better Way to Play

In the past, I have advocated the use of short (VXX) or long (XIV) as ways to profit from steep contango, but there is, in my opinion, a more compelling way to profit from contango, short (TVIX).

is a 2x leveraged version of the VXX which should, in theory, return 2x the daily gains or losses of VXX or similarly structured funds.

However, as many have observed the TVIX had a pretty wild ride this spring. For those not familiar with the fund, in February the fund’s sponsor Credit Suisse temporarily halted creation of new units of the fund in response to skyrocketing demand and ballooning risk exposure for CS. Halting the issuance of new shares broke the mechanism that tends to keep funds trading in line with underlying value, and in a tulip mania moment, the market bid the price up to an 89% premium to fair value in just a few weeks. About a month later, when the sponsor resumed issuing shares on a limited basis, shares traded down sharply and more in line with fair value. Continue reading