Digital World Acquisition Corp (NASDAQ:DWAC) Blank Check Company aka SPAC Proposes to Merge With Trump Blank-Deck Company. Will SEC Investigate?

When “E.F. Hutton Talks”, Will SEC Chairman Gensler Read the SEC and FINRA Rules Prohibiting SPAC Sponsors from engaging with acquisition targets prior to listing??

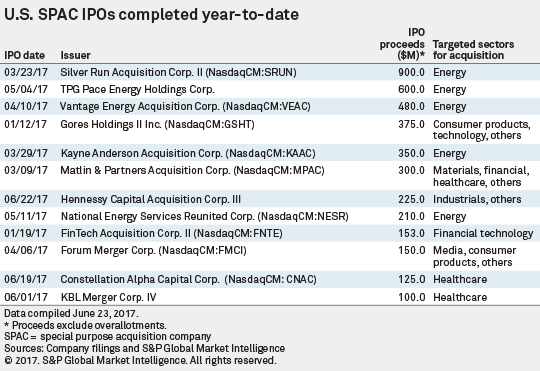

Just when we thought that MarketsMuse coverage of Donald Trump’s financial shenanigans had taken a breather, this past week’s announcement by SPAC sponsor Digital World Acquisition Corp (NASDAQ:DWAC) rocked the stock market and created a rocket-fueled run-up in its share price after the ‘blank check’ company created in December 2020 by Florida-based Patrick Orlando, a former Deutsche Bank derivatives trader turned SPAC promoter would be merging with Florida-based Trump Media & Technology Group (aka TMTG), a blank slate “social media enterprise” with no operating history and established by the former President two months after the formation of “DWAC” (in February 2021).

The Meme of the Week. When the announcement made by the DWAC sponsors and the Trump entity TMTG hit the tapes after the close of trading Wednesday, Oct 20, the following morning, the share price of the Digital World Acquisition Corp, which became publicly listed on NASDAQ six weeks prior, soared from $10 to $75 within a matter of a few hours, and was the second most actively traded stock in America. On Friday, the shares, which cannot be borrowed for shorting other than by broker-dealers, traded as high as $175 before closing at $90 (with the last sale of $80 in Friday’s after-hour trading session).

If the DWAC SPAC shareholders approve of the merger, and if the SEC does not raise a red flag, Trump Media & Technology Group will receive $293 million in cash that Digital World Acquisition Corp has in trust.

So, we now have the next classic example of a “meme stock” (aka “Me-Me”) driven by so-called Reddit Bandits and tens of thousands of retail traders entering buy orders to drive up the price, believing they would force ‘hedge funds’ who might have been shorting the stock to pay even higher prices to cover their positions. It’s a new take on the old-style “short-squeeze pump and dump.”

Read about our coverage of Crypto-Kid Con Artists Andrew Katz and Matthew Krueger. The Saga continues. After being charged with felony assault in New York last year, Seaquake CEO Katz is said to be a “no-show” after failing to appear for Jan 20 2022 sentencing hearing at Manhattan Criminal Court. NOW A Fugitive/CLICK HERE/ for the story.

OK, a slug of buyers who swamped Fidelity, Robinhood, TD Ameritrade, and other brokers are also MAGA cap wearers and anti-vaxxers who will give Trump every last penny of their unemployment checks or social security checks to keep Trump’s hate-filled and anarchy-riddled beliefs front of stage, and to the point of breaking down the doors of the nation’s capitol building.

Here’s the joke: 8 out of 9 of the largest holders of DWAC include the industry’s biggest hedge funds, whose plain-vanilla strategy is to buy SPACs at the initial offering as a means to deploy cash that is not being used by the fund, and with the upside chance the investment will make a profit. Alternatively, stakeholders can redeem or ‘put back’ their holdings to the company at their original cost and get their full investment back after a merger announcement is made. Think of it is as a money market fund that has a “knock-in provision”.

The other largest holder is Arc Global Investments and owns the right to acquire approximately 20% of the authorized shares, which is controlled by none other than Patrick Orlando. Albeit, unlike the nearly 80% of shares acquired by the hedge funds, Arc’s shares have a restriction that prohibits selling those shares for an extended period of time. At least 2 of the 8 hedge funds (SABA Capital and Lighthouse Investors) were owners of several million shares each, and they made tens of millions of dollars inside of two days by unloading their shares to the retail investors, many of whom paid between 500%-1700% more for the shares from the prior day’s price.

The punchline to the joke: The two funds that acknowledged selling to witless retail investors as the stock was skyrocketing did so because they wanted nothing to do owning a company that might eventually enable a Trump-fueled media enterprise initiative.

Fool Me Once, Shame on You. Fool Me Twice Shame on Me. In addition to the Reddit bandits and followers of Wall Street Bets who bought into the shares of the black-check company that proposes to merge with a still non-existent operating business (other than in name only), hordes of die-hard Donald Trump fans and followers with accounts at Fidelity, Robinhood and TD Ameritrade were believed to have purchased “millions of shares” in the past two days and, according to nearly every professional trader and investment manager in the world, “they paid prices that defied any scintilla of logic; proving that the extent of their education must have been a diploma they received from Trump University.”

Click Here for another MarketsMuse most-read feature stories

EF Hutton is the underwriter for Digital World Acquisition Corp? Adding yet another comedic twist to the story, aside from rumors that Hollywood producer and former Treasury Secretary Steven Mnuchin has purportedly secured the film rights to, so that he can do a remake of the 1949 film classic and Academy Award-winning “All the Kings Men” (which ended with the assassination of corrupt politician Willy Stark by one of his cronies (to put the feature photo of this post into context), the underwriter for Digital World Acquisition Corp, was formerly known as Kingsmark Capital*, and is now going by the name EF Hutton, the once legendary stock brokerage that was best known for its tag line, “When EF Hutton talks, people listen!”

*Kingsmark’s brief history includes underwriting “micro-cap” stocks and SPACs, and acquired the EF Hutton name from the estate of the heirs to the original EF Hutton.

A PIPE Offering is Next? Because Trump spokesperson Liz Harrington stated that “TMGT is worth $1.8 billion” (@realLizUSA), this would infer that Digital Media Acquisition Corp would need to do a follow-on sale of shares, presumably via a PIPE offering, to raise an additional $1.5 billion in cash that would meet the valuation that Trump believes his non-operating company is worth. Per link above, a PIPE is a private investment in a public equity.

Based on Friday’s closing price, the SPAC company would need, at very least, to nearly double the amount of shares outstanding from 28 million shares to 40 million shares, and to sell those newly-created shares during the “de-SPACing process (which is unlikely to occur for at least another 2-3 months) at Friday’s closing price of $90 via the PIPE offering.

Yes, the total volume on Friday exceeded 130 million shares, and Wall Street syndicate desks managers suggested any secondary sale (2-3 months from now) could be done with no market impact if trade volumes remain the same and the price remains elevated, yet it would also dilute the existing shareholders by nearly 50%.

To the above, one trader suggested “the odds of the DWAC share price remaining at the current exorbitant price level are about equal to the chances the SPAC will be de-listed after an SEC investigation is started; a50-50 probability for either outcome.”

Why should the SEC Investigate? Will Coincidence Kill the Golden Goose and Lead to a De-listing of DWAC?

Some things for Gary Gensler to Consider Before More Retail Investors Get Completely Burned Buying this “SPAC”.

SPACs cannot identify acquisition targets prior to the closing of the IPO. If the SPAC had a specific target under consideration at the time of the IPO, detailed information regarding the target IPO registration statement, potentially including the target’s, would be required to be included in the financial statements

Under the SEC’s rules, a SPAC may not identify a specific target company prior to the closing of its IPO, and the SEC requires the SPAC to disclose in its prospectus that the SPAC does not have any specific target company under consideration, and that neither the SPAC, nor anyone acting on behalf of the SPAC, has engaged in any substantive discussions with a potential target company. In fact, if a non-binding LOI is entered into before the SPAC’s IPO, the SEC may even suggest that it is the target company that should conduct an IPO, not the SPAC, which would defeat the entire purpose of using a SPAC as an investment vehicle and an alternative to a traditional IPO for the target company.

DWAC’s Prospectus states: “We have not selected any specific business combination target and we have not, nor has anyone on our behalf, initiated any substantive discussions, directly or indirectly, with any business combination target.”

Suspicious Behavior? DWAC listed on NASDAQ on September 3; the merger announcement came less than six weeks later. Typically, it takes many months for a SPAC sponsor to research and perform due diligence on many companies before they bring a proposal to SPAC holders.

SPAC Sponsor and CEO of DWAC Patrick Orlando is a “good friend of Donald Trump”. Orlando resides within a stone’s throw of Trump’s Mar-a-Lago country club and has since acknowledged to the New York Times that he is a “long-time friend of Donald Trump and speaks with him often.”

Collusion or Coincidence? So, is it just a coincidence that Orlando started and completed his due diligence inside of five weeks after the SPAC listed? Or, has there been a major violation of securities regulations, and is the offering prospectus nothing more than toilet paper?

Rule #1: Deny. Deny. Deny. To the above, a Trump spokesperson, speaking off the record (of course!) has since told at least two sources that “Mr. Trump never heard of Patrick Orlando and never communicated with him until weeks after the Digital Acquisition was listed on NASDAQ.”

Really?! At very least, Orlando has already publicly stated that he has been friends with Trump for a number of years and communicates with him ‘frequently’.?

Roma Daravi, a former Trump administration communications executive and the ‘media relations’ representative for TMTG was not available for comment, even if Liz Harrington did comment via Twitter.

Let’s play this back again; DWAC listed on NASDAQ on September 3. Five weeks later they announced proposed merger with Trump’s shell company, TMGT. In the history of SPAC offerings, DWAC has broken the land speed record for listing and then announcing a merger. Their ability to canvass opportunities, perform due diligence on various merger candidates, reach a conclusion, and then execute a merger agreement, all within 5 weeks from the date of listing the SPAC would seem implausible at best, and statistically impossible at worst when considering the average time for this process is 4-6 months.

Let’s try a different angle: The CFO for DWAC is 83 year old Brazilian national Luis Orleans-Braganza. Mr. Orleans-Braganza is a businessman and currently a self-acclaimed “right wing” member of Brazil’s National Congress. Sources say that he has been “a guest at Mar-a-Lago on several occasions” during the past two years.

How About this part of the DWAC Offering Prospectus?

Patrick Orlando’s DWAC Prospectus States “We will identify and complete business combinations with “market-leading companies”. This is identical to the boilerplate verbiage in every SPAC offering document, yet counter-intuitive to the merger announcement if Digital World’s strategy is to identify and complete business combinations with technology-focused, market-leading companies. For more information, please visit www.dwacspac.com

BUT, TMTG has NO operating business, which would be a cause of concern for the institutional and individual investors who put money into this SPAC based on Patrick Orlando’s representations. TMTG has NO employees of record (other than Trump) and their pitch deck, which appeared on the entity’s website at the same time as the merger news hit the tape, reads as if it was written on a blank whiteboard:

Among other things, the Trump pitch deck, which, unlike any other startup pitch deck, fails to identify any management or key employees that will be executing the business strategy, yet it states: “The group plans to offer alternative media to challenge the traditional social networks like Facebook, YouTube and Twitter via a social network called “Truth Social.” One of the slides states “…..envisions to eventually compete against Amazon.com’s AWS cloud service and Google Cloud.”

Other slides suggest “a social network (“Truth Social”) is set for a beta launch next month, and full rollout in the first quarter of 2022, is the first of three stages in the company’s plans, followed by a subscription video-on-demand service called TMTG+ that will feature entertainment, news and podcasts.”

So, we have a blank check company merging with a blank-deck company that is parsing jargon from an array of presentation decks that anyone can download on the internet.

CAVEAT (EMPTOR): Mr. Orlando’s FINRA record is clean (so far) of any misdeeds. The fact that he worked at Deutsche Bank, the only bank that would extend credit to Trump, is likely a mere coincidence.

As of press time, MarketsMuse has not determined whether any DWAC officers, including CEO Patrick Orlando, spoke with or visited with Mr. Trump at Mar-a-Lago or any place else during the two months in which both Trump Media and DWAC were incorporated. We have yet to obtain evidence as to whether members of Orlando’s team communicated with Trump prior to the SPAC listing.

To the above, given Trump’s penchant for “hiding the potato” and withholding evidence, unless the SEC engages the FBI to trace any and all phone, email and/or burner phone txt communications between the interested parties, Gensler’s enforcement agents who are already overwhelmed with tens of dozens of cases, could face a challenge in their attempt to prove that Orlando and Trump discussed and negotiated a business transaction with DWAC prior to the SPAC listing.

Rudy Guiliani to Defend Trump in any securities litigation? Maybe. Then again, if Trump enlists his favorite lawyer to defend him, despite the fact the former prosecutor and former New York mayor was disbarred from practicing law in in New York (and the District of Columbia), he can still appear in a federal court, which is where any SEC prosecution, as well as any securities class action lawsuits brought by investors, would likely be filed. Sounds like a scene from HBO’s “Succession”.

Boondoggle for Class Action Securities Lawyers: This will create a boondoggle for plaintiff lawyers who specialize in class action litigation on behalf of investors that have lost money buying (and or selling) securities of companies that have blatantly run afoul of securities regulations, including disclosure requirements. Investors residing in New York, Florida, California, Colorado, Massachusetts, and other states should click here for a listing of class action securities attorneys in your state.

Lighthouse Investment Partners shed its holdings in Digital World Acquisition after learning of the deal with Trump’s venture, the fund told CNBC. Lighthouse had owned 3.2 million shares, or 11.2% of the special purpose acquisition company, which trades on NASDAQ, according to a Sept. 30 regulatory filing.

Saba had owned a 9.3% stake in the SPAC, or 2.4 million shares, according to a Sept. 3 filing.

Other institutional owners that represent the remaining 80% of shares owned in DWAC include Highbridge Capital Management (2 million shares); D.E. Shaw & Co (2,425,000 shares); K2 Principal Fund (1,175,000 shares); ATW SPAC Management LLC (2,425,000 shares); Boothbay Fund Management (2,425,000 shares); Radcliffe Capital Management LP (2,425,000 shares). As of press time, these funds have not yet published updates as to whether they continue to maintain or have liquidated holdings in Digital World Acquisitions Corp.

If you’ve got a hot insider tip, a bright idea, or if you’d like to get visibility for your brand through MarketsMuse via subliminal content marketing, advertorial, blatant shout-out, spotlight article, news release etc., please reach out to our Senior Editor via cmo@marketsmuse.com