MarketsMuse update profiling a very intriguing options strategy for professional traders is courtesy of a.m. edition of “Sight Beyond Sight” , the global macro strategy-centric publication from Rareview Macro LLC. The MM editors include former option market-makers and we’re reasonably confident that the following idea has not yet been considered by those who pride themselves on innovative, yet low risk option strategies. Caveat: for professionals only.

New Idiosyncratic Situation in Apple & Google…Avoiding the Mainstream Noise

There is no overnight recap today. Instead, we are going to present an equity idea on Apple Inc. (symbol: AAPL) and Google Inc. (symbol: GOOG).

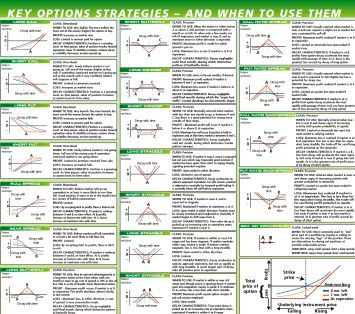

If a discretionary money manager looks at their portfolio construction through the lens of “return streams” one such bucket would be called “idiosyncratic”. It is debatable what type of investment qualifies as “idiosyncratic” but we would argue “option conversion arbitrage” falls into this category nicely.

Option conversion arbitrage does not typically find its way into books about options trading. That is not surprising, given that the term alone would prompt most eyes to glaze over. With a little extra effort, however, this stock and options combination strategy should not be too difficult to fully understand.

Furthermore, demystifying conversion arbitrage does not require an advanced degree in finance or being a veteran market maker. All it will require is a basic understanding of put and call options (both buying and selling), familiarity with stock buying/shorting and knowledge of the stock dividend process. Conversions incorporate these elements, and a few others, in their cost and profitability structures and in the dimension of risk assessment, so you should brush up on them before getting started. Continue reading