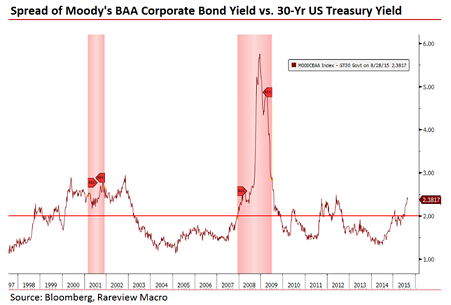

Most sophisticated investors, whether Tier 1 institutional investment managers, ‘top minds’ across the sell-side, or the truly savvy, self-directed types should all agree that fixed income market signals, and investment grade credit spreads in particular are a prelude to what equities market can expect to happen. Whether the ‘lag time’ is 3 months, 6 months […]

Read More