MarketsMuse.com merges Fixed Income and FinTech with continuing coverage of the corporate bond market’s effort to evolutionize via electronification with a focus on yet the latest innovator initiative courtesy of Goldman Sachs alumni Amar Kuchinad and his start-up“Electronofie.” Our hats are off in salute to the catchy company name and…Read More

MarketsMuse Global Macro update profiles perceived opportunities from the perch of Denmark’s Saxo Group Mads KoefoedIt and his view that interest rate increases probably won't happen during the second quarter, but the market will very likely be dominated by speculation on the likely timing of a US Fed interest rate…Read More

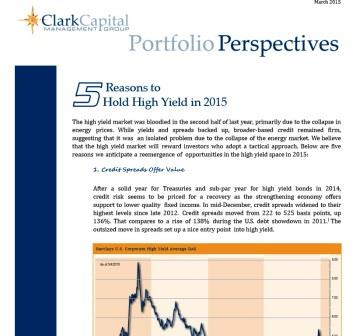

While high-yield bond followers are seemingly caught between a rock and a hard place as interest rates may be poised to pick up, some expert investors are positing that high yield positioning is precisely the tactical approach to maintain.. The following MarketsMuse.com fixed income fix is courtesy of contributed article…Read More

While a certain sect of economists are lamenting the exponential increase in debt issued by an assortment of sovereign entities [and corporate bond issuers] within the context of a feared liquidity crisis if and when rates turn higher and institutional investors might run for the exits at the same time,…Read More

MarketsMuse fixed income and global macro update courtesy of extract from blog post at II’s blog by James Craige, the head of emerging-markets debt at Stone Harbor Investment Partners in New York. Two years of challenged returns, and high volatility, by emerging-markets local currency debt has prompted questions from investors.…Read More

MarketsMuse update courtesy of below extract from Institutional Investor’s profile of Mario Gabelli and his investment vehicle GAMCO’s foray into the actively-managed ETF fracas. Now that exchange-traded funds are a better fit for active managers, Mario Gabelli is signing on. The seasoned investor — who eschews index funds — says…Read More

MarketsMuse blog update courtesy of extract from 27 Feb story from ETF.com’s Elisabeth Kashner and her profile of prop trading firm Virtu, the high-frequency (HFT)“Virtu’s HFT Way To Play Crazy Oil Market” [caption id="attachment_2917" align="alignleft" width="105"] Elisabeth Kashner, ETF.com[/caption] Would you ever sell something to yourself and pay someone…Read More

MarketsMuse update profiling the debut of bond guru and DoubleLine Capital’s founder Jeff Gundlach’s first foray into the ETF space is courtesy of ETF.com.The SPDR DoubleLine Total Return Tactical ETF (TOTL) is launching today (Tuesday, Feb. 24). The $TOTL exchange-traded fund invests in just about every type of debt security,…Read More

MarketsMuse.com update courtesy of extract from Feb 16 CNBC reporting by Alex Rosenberg [caption id="attachment_2844" align="alignleft" width="150"] Alex Rosenberg, CNBC[/caption] There's a major debate brewing in the financial markets, and it concerns the most important potential event of the year for stocks and bonds alike: the timing of a Federal…Read More

Elliott Management Founder Says It’s ‘Nutty’ to Hold Government Debt Below MarketsMuse extract courtesy of FinAlternatives.com’s afternoon edition (which is courtesy of coverage from Bloomberg LP’s Kelly Bit) is a beauty for those who follow the musings of this global macro trading titan…and the comments are consistent with what makes…Read More

MarketsMuse.com update courtesy of extracts from today’s edition of Traders Magazine. Yet another coin is being tossed into the fountain of Bitcoin dreams and wishes. The latest aspirant and first to file a full-blown registration for a "Bitcoin Bourse"with the CFTC is “LedgerX”, a company led by former 6-pack broker-dealer…Read More

As the exchange-traded fund marketplace continues to evolve, the recent introduction of "exchange-traded managed funds", aka ETMFs, has opened Pandora’s Box for those who have embraced "traditional" ETFs because of their transparency, real-time pricing (vs “end of day price setting”) and the relative ease of diagnosing liquidity by interrogating bid-offer…Read More

“And the nominees are…” MarketsMuse update profiles ETF industry portal ETF.com annual awards for ‘Best Of’ across 25 different categories, with more than 100 nominees. Winnners will be announced at an awards dinner that will take place March 19 at Pier 61 in New York City. Below please find the…Read More

MarketMuse update courtesy of ETF.com’s Cinthia Murphy Steven Wallman was a commissioner with the SEC in the mid-1990s. An authority on securities markets and trading, today he leads an ETF-centered online brokerage, Folio Investing. Wallman is also keen on seeing the SEC start using a thoughtful “holistic” method to evaluate…Read More

MarketsMuse update on the downtick in oil prices and impact on high yield bond ETFs, including energy-sectory junk bonds includes extract from Institutional Investor Jan 7 coverage by Andrew Barber. MarketsMuse editor note: The recent implosion of crude oil prices has triggered a conundrum for almost every investment analyst who…Read More

MarketsMuse update courtesy of extracts from 31 December story in industry mag Markets Media.com The buy side is becoming more targeted with sell-side firms, employing a rifle rather than a shotgun approach as liquidity continues to shrink. A big factor behind this newfound independence has been the lessening of liquidity…Read More

Below is excerpt only from today's edition of macro-strategy commentary courtesy of Rareview Macro LLC publication "Sight Beyond Sight" [caption id="attachment_1904" align="alignleft" width="100"] Neil Azous, Rareview Macro LLC[/caption] Firstly, the Stock Exchange of Thailand SET Index (symbol: SET) is showing the largest negative and the Dollar-Rupiah (USD/IDR) is showing the…Read More

Below extract courtesy of 08 Dec edition of MarketsMedia.com; reporting by Steve Marlin Agency Broker WallachBeth Raises Tech Bar WallachBeth Capital, a provider of institutional execution for buy-side investment managers, recently appointed quantitative trading veteran Matthew Rowley to the newly created role of chief technology officer, signaling the firm’s commitment…Read More