The Big Short is coming to a theater near you soon, but the hedge fund industry's cool kid of the year David Miller has traded ahead of his peers by exploiting and being short of the popular ETF industry product: leveraged ETFs and “inverse ETFs”; products that are typically powered…Read More

MarketsMuse Global Macro curators, like many across the hedge fund complex, have attempted to decipher an investment thesis that can prove itself without being hijacked by short-term volatility. Deflation, Inflation, Oil, the Dollar and bets being made in advance of the Fed's widely-expected interest rate adjustment are talking point ingredients…Read More

MarketsMuse Global Macro curators credited with metaphoric title "Dollars and Donuts"--a phrase many of those who trade on institutional desks should appreciate...Snippet below is courtesy of a.m. edition of institutional research unbundler SubstantiveResearch.com Neil Azous from Rareview Macro writes that for all attention being devoted to the equity market at…Read More

Weekend's Geopolitical Events Are Being Ignored.. MarketsMuse curators have been navigating commentary across the media throughout the weekend in search for the various financial industry pundits and opinionators who might add some context to the terrorism that shook Paris on Friday night. No surprise, we noticed the below opening from…Read More

Marathon Asset Management CEO Bruce Richards Leads Crowdfund Campaign for "Veterans Education Challenge" Hedge Fund Honcho Will Match $1mm Raised via Crowdfunding Platform CrowdRise (RaiseMoney.com) For those Wall Street sharks and finance industry wonks who haven’t yet received the memo about crowdfunding, you might want to dial in to hedge…Read More

9 November (BrokerDealer.com)--Broker-Dealer Mischler Financial Group (“Mischler”) , the securities industry’s oldest minority investment bank and institutional brokerage owned and operated by Service-Disabled Veterans announced that in connection with the firm’s annual recognition of Veteran’s Day, Mischler has pledged a portion of the firm’s entire November 2015 profits to The…Read More

While 99% of market pundits have been busy for the past months laying odds and making bets as to precisely when and how much the Fed will raise interest rates, a small universe of Fed Watchers have picked up on a surprising nuance that few seasoned market experts have even…Read More

"To put it bluntly, what headline writers or traders are selling you today is a load of bollocks." Neil Azous, Rareview Macro LLC When global macro guru Neil Azous of Rareview Macro appeared on CNBC midday yesterday, MarketsMuse curators had already absorbed and relayed his recent views about energy prices,…Read More

Professional Investment Community Cries Out in Agony and They Don’t Yet Know Exactly Why MarketsMuse Strike Price and Global Macro curators voted the Oct 5 edition of global macro advisory firm Rareview Macro's Sight Beyond Sight the best read of the week. Yes, its only Monday, but those who follow…Read More

MarketsMuse news curators have spotted dozens of commentaries from leading equities and debt market pundits opining about global mining giant Glencore. There is only one comment that offered a truly rare view that struck a chord, and it is courtesy of this morning's edition of global macro newsletter "Sight Beyond…Read More

For Wall Street bankers and brokers who have been in the business since at least the early 2000's and are still working on the Street, and who think you've already been pilloried plenty for the work you do, watch out, former Lehman broker-turned best-selling author Michael Lewis ("Liar's Poker", "Money…Read More

MarketsMuse Global Macro merges with Strike Price seers with sage excerpt from 18 Sept edition of "Sight Beyond Sight", the daily newsletter published by global macro think tank Rareview Macro and authored by Managing Member Neil Azous and rising star Michael Sedacca...For fans of the film Draft Day, this excerpt…Read More

MarketsMuse editors were relieved yesterday after the Fed announcement for two reasons; the first being we were reminded that at least half of Wall Street's Fed-watching pundits who get paid big bucks to predict events can be replaced by anyone who can flip a coin, as half of the pundits…Read More

MarketsMuse Global Macro curators always look for substantive and objective observations from outlets that are truly substantial within the context of presenting thoughts and comments from experts followed by the most discerning investors. With that in mind, we salute the folks at UK-based Substantive Research for this morning's note, which…Read More

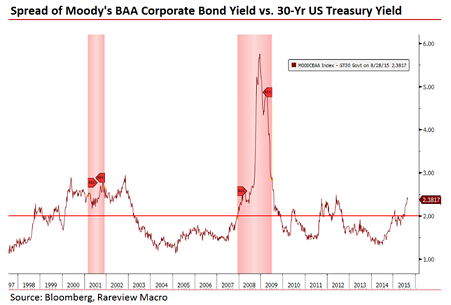

Most sophisticated investors, whether Tier 1 institutional investment managers, 'top minds' across the sell-side, or the truly savvy, self-directed types should all agree that fixed income market signals, and investment grade credit spreads in particular are a prelude to what equities market can expect to happen. Whether the 'lag time'…Read More

For RIAs who want to be smarter (and at the same time, earn CFP and CE credits, MarketsMuse points you to the Sept 17, Forbes Advisor Playbook iConference. Why? Well for one, Shark Tank shark extraordinaire Kevin O'Reilly a newbie ETF Issuer of exchanged-traded funds firm "O'Shares" (whose first product…Read More

If the second shoe is actually falling as US (and all other) equities markets appear to indicate this morning, MarketsMuse ETF and Global Macro editors were stimulated by having Sight Beyond Sight with this morning's coffee, courtesy of Rareview Macro's Neil Azous. Of particular interest, Azous points to Mebane Faber’s…Read More

One needs to have 'been there and seen that' for at least twenty years in order to have been "loaded for bear" in advance of this morning's equities market rout. At least one of the folks who MarketsMuse has profiled during the past many months meets that profile; and those…Read More