Just when you were about to ask “What’s the next type of exchange-traded fund that nobody else has come up with?, PureFunds has launched a fintech ETF!

If you’re not familiar with the phrase ‘fintech’, you’re likely not qualified to put assets into this latest exchange-traded fund that specializes in one of the hottest trends-financial technology companies.

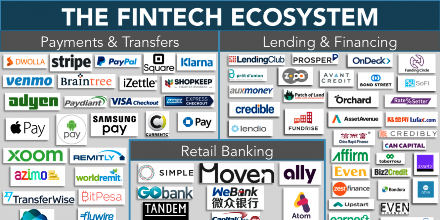

Caveat: According to 4 Pinocchio star winner Donald Trump, “Many people are saying..” that “fintech” is a phrase associated with start-up companies focused on delivering innovative software applications used to streamline financial industry centric services. The fact is that ‘fintech’ is a term that is applied to the full gamut of companies that specialize in financial industry technology solutions, as evidenced by the criteria for constituents within PureFunds latest ETF product, Solcative Fintech ETF (FINQ).

“FINQ allows investors to invest in this fast-growing segment of the industry without having to select individual companies. The rules- based index approach allows us to capture exposure to companies at the forefront of innovation in the financial industry.”

But don’t just take our word for it, below is the press release that just crossed the tape..

SUMMIT, N.J.–(BUSINESS WIRE)–ETF Managers Group in partnership with PureFunds today debuted their newest fund, the PureFunds Solactive FinTech ETF (FINQ).

“FINQ allows investors to invest in this fast-growing segment of the industry without having to select individual companies. The rules- based index approach allows us to capture exposure to companies at the forefront of innovation in the financial industry.”

Trading on the NASDAQ, the fintech ETF “FINQ” invests in global companies disrupting the multi-trillion dollar financial industry by offering technology-based solutions designed to revolutionize how financial industry firms interact with their customers and run their businesses.

The fund’s holdings include technology services companies that principally derive revenue from the sale of financial-related information, financial data analysis services, financial services software tools or platforms or web-based financial services. Each company in the fund and its corresponding index – 31 in total – has a minimum market cap of $200 million.

“Financial technology is a rapidly growing subsector of the overall financial services industry, and our fintech ETF FINQ seeks to tap into the potential investment opportunity created by these disruptive, forward- thinking companies,” Andrew Chanin, CEO of PureFunds, said. “FINQ allows investors to invest in this fast-growing segment of the industry without having to select individual companies. The rules- based index approach allows us to capture exposure to companies at the forefront of innovation in the financial industry.”

If you’ve got a hot tip, a bright idea, or if you’d like to get visibility for your firm through MarketsMuse via subliminal content marketing, advertorial, blatant shout-out, spotlight article, etc., please reach out to our Senior Editor

Sam Masucci founder and CEO of ETF Managers Group said, “The idea behind PureFunds ETFs is to make available – in a single diversified investment – unique areas within markets that have been greatly enhanced by technology. Technology allows businesses to offer new innovative services that can positively affect a consumer’s experience.”

FINQ will cost 68 basis points* and will be equal weighted. It joins PureFunds’ suite of products, BIGD, GAMR, HACK, IFLY, IPAY, SILJ and IMED, which also begins trading today on the NASDAQ.

* A basis point is one hundredth of a percent

About PureFunds

As an innovator of ETF concepts, PureFunds® strives to provide the market with easy access to in-demand industries through pure-play ETFs. We are a New York City-based research and business management firm, serving as the Manager and/or Sponsor to the suite of PureFunds ETFs. We aim to provide investors with tactical ETFs that may offer attractive investment opportunities in sectors that traditionally have been difficult to invest in. With vast experience in global equity investing and ETF trading, PureFunds has a refreshing and alternative insight into the growing world of ETFs. We have constructed our distinct suite of products in an attempt to meet the needs of investors and traders alike.

About ETF Managers Group

ETF Managers Group, LLC is a leading Exchange Traded Funds (ETF) private label services company. ETF Managers Group offers a full range of ETF product services to the asset management community including commodity pool ETPs as well as both active and passive ETF funds. The services provided include product operations, regulatory, financial and compliance management. ETF Managers Group offers active marketing and dedicated wholesale services for all ETF product types and index construction.