(MarketsMuse blog post image courtesy of Institutional Investor)–Thanks to MiFID II, Sell-Side Research Analysts are not only unwanted, they will become increasingly underemployed in terms of compensation, or simply unemployed. This increasing view is bleak for investment bank research wonks, but provides for a career re-purposing on the part of experienced research analysts. At least that’s one thesis, as advanced by Institutional Investor’s Amy Whyte. (link to article below).

Wall Street’s investment bank research analysts, the folks who have long been notorious for peddling buy recommendations on companies in which their respective firms serve as the lead or co-lead underwriter to the company whose shares and/or bonds they tout are now facing a new professional career dilemma and its directly related to MiFID II, the EU’s revamped financial industry regulatory framework. Part of the new regs that rolled out at the beginning of 2018 require investment banks to charge their clients separately for research provided, as opposed to bundling the cost of research within trade execution fees/commissions charged to clients. This is actually a very big deal, as it now puts the onus on investment banks to not only justify the “value” of their manufacturing buy recommendations, but opens Pandora’s Box insofar as institutional investor clients of those banks can now measure the value of that research in a granular fashion.

MiFID II’s negative impact on investment bank research analysts is one that is perhaps bigger than the reputational crisis they suffered consequent to the bursting of the internet bubble during the turn of this century. Back then, research analysts were castigated for peddling grotesquely overvalued dot com stocks–many of which imploded within less than 2 years of their banks underwriting the IPOs of the same companies. For those not familiar with history, a simple revisit to the wikipedia page of former Merrill Lynch Analyst Henry Blodget provides a case study in conflicted commentary peddled by analysts back in those days (keep reading below for the Blodget story). Point being-sell-side research analysts were (deservedly) thrown under the bus for being conflicted in their recommendations, leading to a short-lived surge in startup independent research firms. Now, investment bank research analysts are facing another career crisis thanks to unbundling research regulations introduced by MiFID II.

Unbundled pricing models will change research market forever (Bloomberg Intelligence Aug 2017)

Banks are adjusting their pricing models for investment research in preparation for EU reforms that will prevent research from being paid for directly using dealing commissions. In an unbundled world, based on execution-only commission rates where payments for research are separated, competition in equity research, as well as fixed-income, currency and commodities research, is likely to rise. Managers may look beyond traditional sources, triggering fragmentation. They may also move research in-house.

But all is not as bad as it sounds for the research analyst community at large. Sell-side research analysts who have strong pedigrees are presumably well-positioned to take on similar roles at buy side firms, or as the II article suggests, these folks are nicely qualified to serve as Investor Relations professionals for corporations. For US-based analysts, the urgency to repurpose is not as severe as it might be for their EU counterparts, as the US SEC has provided a reprieve for the time being according to one expert.

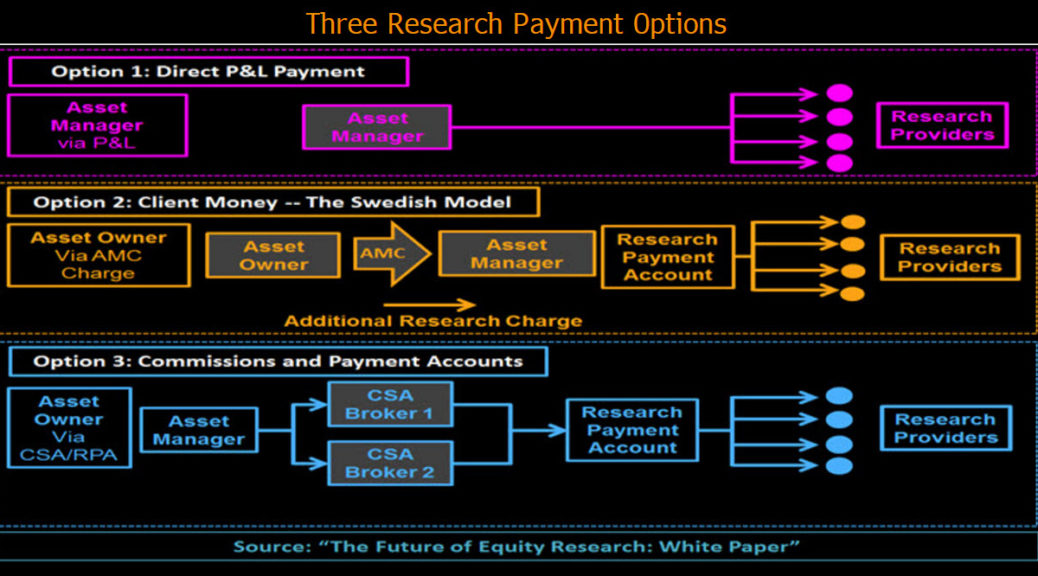

MiFID 2 regulations require investment research to be paid for in one of two ways: from a fund manager’s own account, which may be recoverable by raising fees, or via a ring-fenced client research-payment account. While regulators will permit research charges to be collected alongside transaction commissions, subject to strict conditions, there should be no link to transaction value or volume. The move to an unbundled research model will limit the long-held use of commissions and is being disruptive to the industry globally.

Flashback to Blodget….Putting into context, he was the 1990’s icon for being a dot com MarketsMuse. The likes of Henry Blodget made no bones promoting dot com stocks underwritten by his former employers Oppenheimer & Co and then Merrill Lynch. Blodget was ultimately barred for life from the securities industry for his egregious touting and to make sure the door didn’t slam his butt on the way out of Wall Street, he paid a $2mil fine and agreed to give back another $2mil that he earned while being the most prolific stock promoter of his generation. Good news-Blodget repurposed himself and is co-founder/CEO, Editor-in-Chief and publisher of financial industry rag Business Insider.

If you’ve got a hot insider tip, a bright idea, or if you’d like to get visibility for your brand through MarketsMuse via subliminal content marketing, advertorial, blatant shout-out, spotlight article, news release etc., please reach out to our Senior Editor or email: cmo@marketsmuse.com.

Here’s the article from Institutional Investor