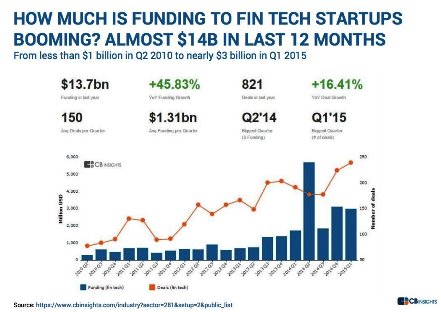

As reported by FINalternatives.com and extract below, MarketsMuse tech talk editors note that investments in financial technology (FINtech) deals nearly tripled in the United States in 2014, according to a new report by Accenture and the Partnership Fund for New York City.

The value of fintech investments in the United States soared to $9.89 billion in 2014, up from $3.39 billion in 2013.

The value of fintech investments in the United States soared to $9.89 billion in 2014, up from $3.39 billion in 2013.

This 191% increase dwarfs the increase in 2013, when fintech deal values in the United States climbed 68%. In New York, fintech deal values grew by 32% in 2014, to a new high of $768 million.

The report, Fintech New York: Partnerships, Platforms and Open Innovation was released Thursday at the FinTech Innovation Lab’s fifth annual Demo Day event in New York.

According to the report, global fintech investment tripled in 2014, to $12.2 billion, from $4.05 billion in 2013. By comparison, the overall market for venture-capital investing increased only 63% during that period.

“This past year marked a paradigm shift in how financial services companies approach and embrace fintech innovation, as they recognize the vast potential that this strong network provides,” said Robert Gach, managing director of Accenture Strategy Capital Markets. “An increasing number of banks and insurers are investing in connecting into the fintech ecosystem, whether through accelerator or incubator labs, venture investments or in other ways. We believe this explosive growth in fintech will help drive innovation within some of the world’s largest financial institutions.”

Where the Money is Going Continue reading