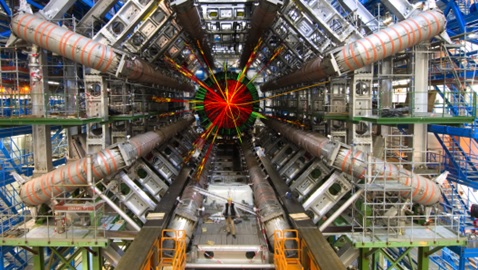

Messing With Data aka When “Art” Smashes into “Science” in Wall Street’s Version of the Hadron Collider

MarketsMuse Fixed Income update comes consequent to the Fed’s June 5 release of Employment Data, and below is courtesy of extracted comments delivered to institutional clients of Mischler Financial Group under the banner “Quigley’s Corner” and authored by Managing Director Ron Quigley, Head of Fixed Income Syndicate for the securities industry’s oldest and largest minority firm owned and operated by Service-Disabled Veterans. Mischler has been awarded “Best Research-BrokerDealer” for the past two years by The Wall Street Letter.

The large Hadron Collider in Geneva’s CERN Institute or the European Organization for Nuclear Research took ten years to build. It’s the largest single machine on our planet. 10,000 scientists worked on it from 100 countries. Talk about diversity and inclusion! It rests as deep as 825 feet underground and its circumference is 17 miles. It was created, in essence to help find answers to questions that have bugged mankind like “where do we come from?” or “How was the universe started” among many others. CERN hires roughly 90% of the world’s particle physicists otherwise known as the smartest people on earth. My late father-in-law was its director and worked there for over 40 years. They are exacting people, detail oriented and with no room for error. Which leads us into today’s Op-ed concerning U.S. economic data and its vast differences but equally important impact in today’s inextricably global-linked world economy. Like the circular Hadron collider – what goes around comes around. So, what happens with rates, the EU, Greece, China and Ukraine, terrorism and/or Nationalism can all have an explosive domino effect. Given that our current rate situation seems tenuous with equally profound global ramifications, I thought the analogy appropriate. Continue reading