If the second shoe is actually falling as US (and all other) equities markets appear to indicate this morning, MarketsMuse ETF and Global Macro editors were stimulated by having Sight Beyond Sight with this morning’s coffee, courtesy of Rareview Macro’s Neil Azous. Of particular interest, Azous points to Mebane Faber’s The Ivy Portfolio for those who have defaulted to using exchange-traded funds and to the reference to Occam’s Razor, a principle that global macro enthusiasts will appreciate.

Without further ado, please find an extract from this morning’s edition of Sight Beyond Sight…

Corporate Buybacks Not Strong Enough to Save Stocks Today…Retest of the Lows Now Underway

- Negative Statistical Analogs

- No September First of the Month Inflows

- China Quantitative Tightening (QT)

- Trends Switch to Medium- from Short-Term

- Correlation Breakdown

The key takeaways to start September are invisible to the naked eye; a little sight beyond sight is required this morning in order to see them clearly.

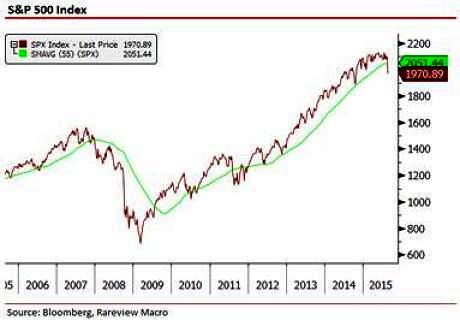

Firstly, we are not sure who the source was, but the following S&P 500 analog was sent to us:

In the 11 times the S&P 500 fell by more than 5% in August it declined in 80% of the subsequent Septembers; the average decline in September in those years was 4%.Now, there are many statistics with similar odds of success being circulated out there, but in aggregate these one-liners miss the bigger picture, in our opinion.

The message is that the higher volatility witnessed during August has carried over into September. It took eight hours of the overnight session for S&P futures (ESU5) to confirm 65% of the above analog, as the index was -2.6% at one point.

Secondly, the first of the month inflows into risk assets that professionals are accustomed to relying on to support their long equity positions has gone missing this year. Inflows into equities are generally expected to follow the simultaneous release of PMI manufacturing data, especially when the data historically points to a stronger global growth profile. However, the data released this morning was uniformly weak, and serves as a reminder of the regional synchronicity – that is, Japan’s consumption-led recovery is faltering, the US has a second half of the year inventory overhang to work through, Europe’s inflation profile is reverting back to pre-“QECB” profile, and China remains an unknown.

Thirdly, given the overall weakness in risk assets the sell-off in the German Bund (RXU5) over the last 24-hours is confounding professionals. Occam’s Razor, a principle that states that among competing hypotheses that predict equally well, the one with the fewest assumptions should be selected, suggests that the Chinese central bank is once again selling dollars and foreign fixed income reserves to buy yuan. As a reminder, FX intervention means foreign reserves have to shrink. The mechanics are as follows: sell foreign sovereign bonds > receive US dollars (USD), euro (EUR), yen (JPY) > use USD/EUR/JPY proceeds to buy CNY = no impact to private economy.

The Chinese Yuan, both the onshore (USD/CNY) and offshore (USD/CNH) versions, is trading at its strongest level since the devaluation. The key difference today however is that the central bank is not defending yuan weakness. Instead, in the spirit of managing volatility, it appears it is proactively reminding speculators who their daddy is and doing a good job of crushing their souls at the same time.

Next.. Continue reading