Excerpt from this a.m.’s Wall Street Journal

Across Wall Street, traders take note when big ETF managers like Good Harbor step into the market, moves that can affect prices. At times, they may try to profit by jumping ahead of Good Harbor, potentially chipping away at returns for its investors, people familiar with the market said.

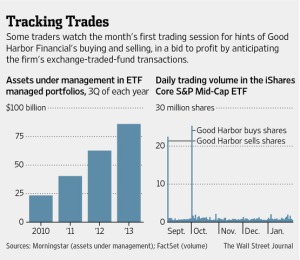

On Monday, February’s first trading session, traders again will be watching for Good Harbor to make a move. [This is because those traders believe that Good Harbor, the $10bil AUM advisor specializing in ETF strategies effects portfolio rebalance strategies on the first trading day of every month.]

“It’s on people’s calendars,” said one ETF trader at a brokerage firm. “Good Harbor pushes a button, and it moves the whole market.”

Good Harbor manages or advises on $10.8 billion, more than double the $4 billion at the end of 2012, according to the firm’s own tally Good Harbor is one of the highest-profile money managers in the fast-growing ranks that use ETFs to build portfolios, rather than individual stocks and bonds. ETFs are generally low-cost funds, designed to track market benchmarks, whose shares trade on exchanges.

Good Harbor manages or advises on $10.8 billion, more than double the $4 billion at the end of 2012, according to the firm’s own tally Good Harbor is one of the highest-profile money managers in the fast-growing ranks that use ETFs to build portfolios, rather than individual stocks and bonds. ETFs are generally low-cost funds, designed to track market benchmarks, whose shares trade on exchanges.

For the full WSJ article courtesy of Chris Dieterich, please click here