MarketMuse update courtesy of ETF Trends, Tom Lydon. Tom Lydon highlights Recon Capital ETF that follows a covered call strategy successful first year.

A little unknown exchange traded fund that follows a covered call strategy has generated robust dividend yields over its first year.

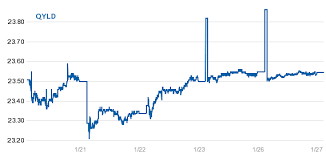

The Recon Capital NASDAQ-100 Covered Call ETF (NasdaqGM: QYLD), which began trading on December 12, 2013, has provided a distribution yield of 10.4% in 2014, according to a press release.

QYLD provides a covered-call strategy that targets Nasdaq-100 securities. Additionally, for those who rely on regular income payments, the ETF provides monthly distributions.

The covered-call options strategy allows an investor to hold a long position in an asset while simultaneously writing, or selling, call options on the same asset. Traders would typically employ a covered-call strategy when they have a neutral view of the markets over the short-term and just bank on income generation from the option premium.

In a flat market condition, the trader would use the buy-write strategy to generate a premium on the option. If shares fall, the option expires worthless and one still keeps the premiums on the options. However, the strategy can cap the upside of a potential rally – the trader keeps the premium generated but any gains beyond the strike price will not be realized.

During last year’s rally, QYLD underperformed the broader market, rising 3.6% over the past year. Nevertheless, the ETF somewhat made up the difference through its robust income generation on option premiums.

The monthly options premiums also provided a buffer from market volatility and helped hedge traditional investment allocations. The covered-call ETF strategy may act as a decent alternative investment strategy to a traditional equity and fixed-income portfolio, especially in the environment ahead.

“Unlike many fixed income investments, QYLD faces no headwinds from rising interest rates, nor is it susceptible to duration risk,” Kevin R. Kelly, Managing Partner of Recon Capital, said in the press release. “Rather, QYLD seeks to provide investors with a low volatility, non-leveraged, tax-efficient product that pays out a monthly income, instead of making distributions by quarter or on an annual basis. We are proud to round out 2014 – and the first year of QYLD trading — with a 10.4 percent yield for our investors, particularly as the 30 Year Treasury sits below 2.75 percent.”