MarketsMuse editor note: The following post, extracted from Jan 6 submission to ETFtrends.com is best described as an advertorial courtesy of WisdomTree Investments, one of the ETF industry’s leading Issuers. While readers of MarketsMuse might be inclined to muse “[This ‘case study’ is] Elementary, my dear Watson, totally elementary!,” MarketsMuse editors would retort: “You would be astounded by the number of ‘sophisticated’ investment managers who somehow still don’t understand how block trades in ETFs are best executed, and precisely who these managers should be seeking objective guidance from before hitting a “send” button.

Equally important: the below submission makes frequent reference to ETF “market-makers”, a phrase that traditionally infers “proprietary trader who is taking the other side of a customer’s trade in order to extract a trading profit.” In today’s market structure, those who ‘make’ markets also include agency-only brokers, who, unlike traditional “market-makers”, agency brokers perform a similar role within the context of providing best available 2-sided quotes; they act as fiduciaries and specialize in sourcing liquidity from among an assortment of “market-makers. Instead of trading against customers, these brokers act in the interest of customers and simply charge a pre-disclosed commission for sourcing liquidity and executing the right price. As such, these agency-only experts act in the interests of the customer and [arguably] are the best route for fiduciaries who seek best price based on an aggregation of all available bids and offers that are typically not displayed on ubiquitous, screen-based markets.

Here is the extract of WisdomTree’s submission:

This blog post is relevant to institutional investors interested in trading exchange-traded funds (ETFs) in significant volume. Individual investors do not always have access to liquidity providers to trade ETFs as referenced below.

This blog post is relevant to institutional investors interested in trading exchange-traded funds (ETFs) in significant volume. Individual investors do not always have access to liquidity providers to trade ETFs as referenced below.

What if I told you that a large $500 million order and a smaller $1.2 million order traded in the same ETF, but one executed around the bid/ask spread and the other drove up the ETF price 84 cents, or almost 5%. Could you guess which trade was responsible for each outcome? The answer may surprise you. The $500 million notional block traded in-line, and a small order of $1.2 million notional block pushed the WisdomTree Brazilian Real Fund (BZF) price 5% away from its underlying value. The trades were done on different days and times, but the price of the ETF and its trading characteristics were similar. So what was the difference between the two trades?

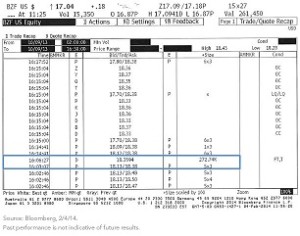

On October 9, 2013, a 27-million-share block order worth approximately $500 million executed inside the bid/ask spread of BZF. You can see the trade in the highlighted area in figure 1.

The client who initiated that trade was able to work with an ETF liquidity provider who had the ability to access the underlying basket in the primary market on behalf of the client. It is important to remember that an ETF is at least as liquid as its underlying securities, regardless of the average daily volume. That demonstrates the beauty of the open-ended ETF structure and its ability to create new shares and redeem shares daily. This trade was successful from an execution standpoint because the client worked together with their trading partners on a best execution strategy.

On the other side of the execution spectrum, another investor entered a 70,000-share ($1.2 million notional value) market order in BZF on November 13, 2014, just before 3:39 p.m. ET. This resulted in a quick spike up in the price of the ETF, as you can see in figure 2.

In this second example, the order book, or depth of the bids and offers of the ETF trading on the exchange, handled a market order of this size in an inefficient manner. The depth of bids and offers in an ETF order book is not always reflective of the liquidity of the underlying asset. While there is a lot of liquidity in Brazilian Real forwards, there are not a lot of resting orders in the BZF order book. By definition, a “market order” is designed to buy or sell an investment immediately at the best available price on the secondary market and will not stop until completed. For this reason, the order for 70,000 shares swept up all available shares for sale until it was completed, which resulted in the price increasing by almost 5%. This was followed by the price of the ETF correcting back in line with the “indicative value” of the underlying basket. Figure 3, and the yellow arrow, illustrate how quickly the order was filled and how far the price moved to satisfy the 70,000- share buy order in the order book.

You may be wondering, “Isn’t there a market maker who is supposed to be providing liquidity so this doesn’t happen?” The answer is yes. [MarketsMuse editor note: But unlike the days of yore, when stock exchange floor specialists were required to ‘take the other side’ of investor orders within the context of prevailing volume, the ‘new market structure’ does not mean that a market maker must provide any more than that he or she would be willing to buy or sell on either side of the prevailing quote. And, because the “beauty” of today’s electronic markets is that bid-offer spreads can move more quickly than you can blink your eye, a market order typically moves so fast that it may not provide enough time for the market maker to “reload” their bid or offer on the screen before the order has driven up the price significantly.]

In summary, these two examples are something that all ETF investors can learn from. On the Capital Markets Team at WisdomTree, we try to be proactive in consulting with our clients on best- execution strategies. For larger orders, always look to work with a liquidity provider who can access the underlying basket on the clients’ behalf and provide execution close to the “fair value” of the ETF. Lastly, we encourage all investors to be sure to have a full grasp of the depth of the order book before implementing any market order. We hope this information helps investors in future ETF.

For the full article at ETFtrends.com, please click here