Courtesy of WCI top gun Matt Buckley ..For those loving Russia, here’s a market neutral thesis that capitalizes on volatility.

..For those loving Russia, here’s a market neutral thesis that capitalizes on volatility.

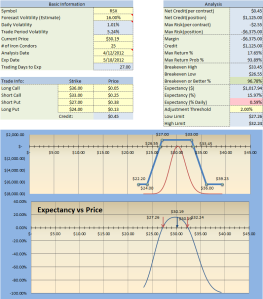

“RSX Implied Volatility is overpriced relative to its forecast volatility of 5.24% over the trade period. We are looking for possible price movement but for it to stay within its $27.00 to $33.00 price range until the exit of this trade.”

Tactic: Opening 25 RSX May 2012 Iron Condors (strikes [24/27/33/36]) for a $0.45 credit

Tactical Employment of Iron Condor:

- Buying to Open 25 RSX May 2012 $36.00 Calls

- Selling to Open 25 RSX May 2012 $33.00 Calls

- Selling to Open 25 RSX May 2012 $27.00 Puts

- Buying to Open 25 RSX May 2012 $24.00 Puts

- Net Credit: $45.00 per Iron Condor for a total of $1125.00

- Max Gain: $1125.00

- Max Risk: -$255.00 per Iron Condor for a total risk of -$6375.00