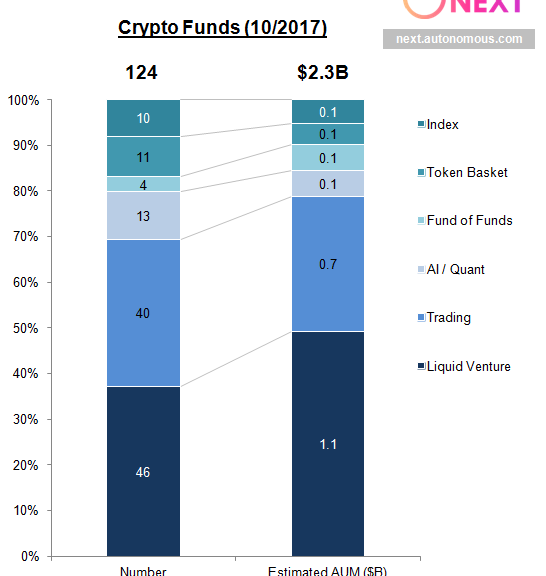

What’s Next for exchange-traded-fund land? Blockchain ETFs! Duh?! Aside from the efforts by the Winklevoss Boys and a cadre of others to introduce a Bitcoin ETF, Blockchain companies (now known as ‘blocktech’ firms) fall into the sweet spot for fintech investors and public companies that are pivoting, re-purposing or adding to their value proposition with a blockchain-based approach to enhancing e-commerce, big data applications or other tools are top candidates for an exchange-traded fund dedicated to the world of crypto and distributed ledger.

As noted by ETF.com, “..Today sees the debut of two Blockchain ETFs focused on blockchain technology, the first blockchain exchange-traded funds of their kind. The actively managed Amplify Transformational Data Sharing ETF (BLOK) lists on the NYSE Arca and comes with an expense ratio of 0.70%, while the index-based Reality Shares Nasdaq NexGen Economy ETF (BLCN) lists on the Nasdaq and comes with an expense ratio of 0.68%…”

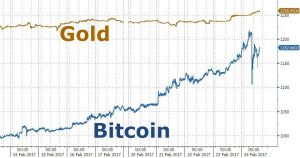

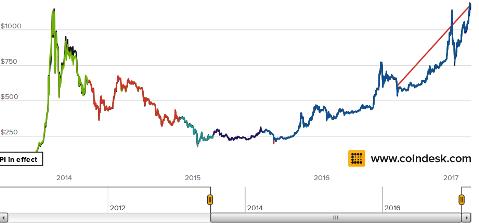

In case you’ve been hiding under a brick for the past many weeks, blockchain technology is in the spotlight due to the mania surrounding bitcoin and other cryptocurrencies. If you were not aware, blockchain technology is the engine that powers the sauce that goes into cryptocurrencies. To coin the phrase (pun intended, courtesy of MarketsMuse top pundit), “Its all about the blockchain, Blockhead! Not the bitcoin!” –meaning the blockchain is foundation to wider applications, not just supporting digital money. In other words, blockchain serves as a “distributed ledger” that provides a secure and unalterable record of transactions that have taken place and other key pieces of information, storing them in linked blocks of data. Think of blockchain as a multi-dimensional spread sheet that lives in real-time and is refreshed with every interaction by those who are enabled to access the application. The bitcoin or token element is therefore the key or passport to accessing the spread sheet. So, it seems to make sense that as more companies seek to leverage this new generation technology, there will be more prospective candidates for blockchain ETFs, which are likely to morph.

ETF.com commentary profiling the new listings continues with “..BLOK was actually the first blockchain ETF to go into registration. The fund can invest in domestic and non-U.S. securities, including depositary receipts, according to the prospectus. It will focus primarily on firms that are developing or using blockchain or similar technologies.

According to Christian Magoon, founder and CEO of Amplify ETFs, developments among the companies in his firm’s Amplify Online Retail ETF (IBUY) alerted him to the fact that cryptocurrency was an emerging trend.

“That started to get us interested in the blockchain equities side of things given the potential of blockchain technology to disrupt; it certainly seems to have potential that is almost similar to the internet’s,” Magoon said.

The range of companies allowed in the portfolio covers those engaged in research and development, and the implementation of blockchain and similar technologies; those profiting directly and indirectly from demand for such technologies; those partnering with companies engaged in blockchain research, development and implementation; and those that belong to consortiums or groups formed to explore the potential of such technologies. Companies must also meet minimum size, price and liquidity thresholds.

Further, the portfolio managers consider the depth of the involvement of companies when selecting them for inclusion in the portfolio, classifying those that are selected as either “core” or “secondary” companies based on their activities, the prospectus said.

Magoon describes the fund’s strategy as “skating where the puck will be.”

“We think companies that are leaders today in researching, investing in or receiving revenue from blockchain are going to be well-positioned for tomorrow—similar to companies that engaged in internet technology early on,” he said.

Magoon’s firm offers actively managed and index-based ETFs, but he believes active management is particularly important for a fund such as BLOK.

“Our key differentiator is that we believe you have to be active when you engage in this space. In order to capture the upside and manage downside risk, you have to be, on a daily basis, looking at this and adjusting your portfolio,” he said, noting that a manager can slowly build or unwind positions, whereas index funds tend to make very binary decisions regarding including or selling a company. Further, while an index fund must wait until its scheduled rebalancing to reflect changes in the market, an active fund’s manager can react immediately.

Keep reading the story directly from the source..

If you’ve got a hot insider tip, a bright idea, or if you’d like to get visibility for your brand through MarketsMuse via subliminal content marketing, advertorial, blatant shout-out, spotlight article, news release etc., please reach out to our Senior Editor or email: cmo@marketsmuse.com.

The bitcoin ETF is the brainchild of Harvard-educated investors Cameron and Tyler Winklevoss, the twin brothers who for years claimed to be the genius behind the creation of Facebook (NYSE:FB). The pair first submitted their initial offering prospectus for a bitcoin exchange-traded fund nearly four years ago. They have since modified the offering documents several times in an effort to appease securities regulators. If approved, everyday investors will have simple access to the cryptocurrency on a major exchange for the very first time, which would no doubt legitimize Bitcoin’s existence and according to some, likely push its value much higher.

The bitcoin ETF is the brainchild of Harvard-educated investors Cameron and Tyler Winklevoss, the twin brothers who for years claimed to be the genius behind the creation of Facebook (NYSE:FB). The pair first submitted their initial offering prospectus for a bitcoin exchange-traded fund nearly four years ago. They have since modified the offering documents several times in an effort to appease securities regulators. If approved, everyday investors will have simple access to the cryptocurrency on a major exchange for the very first time, which would no doubt legitimize Bitcoin’s existence and according to some, likely push its value much higher.