Below is courtesy of Feb 23 commentary from “Quigley’s Corner”, aka debt capital market observations from Mischler Financial Group’s Head of Fixed Income Syndicate, Ron Quigley. Mischler Financial Group is also an award winner; a panel of industry judges assembled by financial industry publication Wall Street Letter voted to award the firm “WSL 2015 Award for Best Research/BrokerDealer.”

The Big Four Central Banks as the World’s Fastest Growing Asset Class

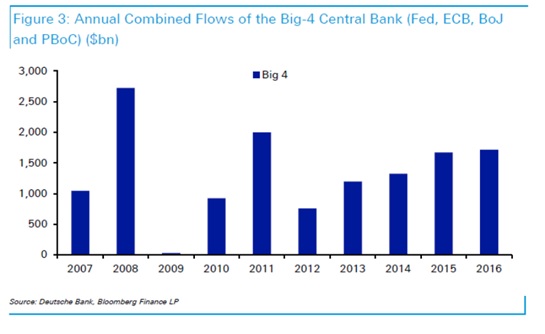

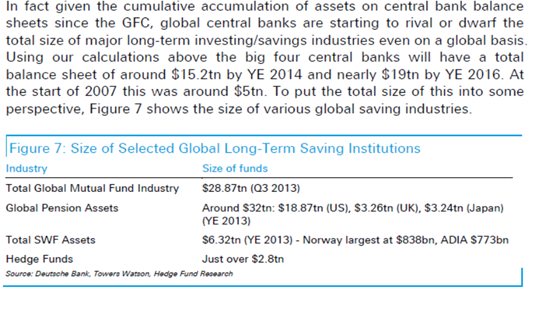

I had a wonderful conversation over dinner this weekend with a highly intellectual and personable Russian player in our markets. We discussed Greece and the additional overtime round of “kick-the-can” that postpones pain by four more months. But what seemed even more compelling was the notion of the Big Four Central Banks as the world’s fastest growing “asset class.” (The Fed, the ECB, BOJ and PBoC). Deutsche Bank illustrated in a recent research piece, the staggering numbers of Big Four Central Bank purchases. The Central Banks have clearly become an asset class all its own. It’s right up there the with cumulative total of U.S. pension funds! Digest that for a second readers! As my friend wrote to me:

When this persistent buying stops, there will be a very large adjustment on a global scale. But this can go for another decade, and results in a “Mexican standoff” between CBs. The media calls it “currency wars.”

Some people are calling for the Fed to use the current rate environment to unwind some of their QE portfolio, instead of raising rates which might actually be a good idea, but it would most definitely prolong the QE strategy, because people will read it as a sign of success.

Now here’s the kicker – as an asset class all their own, think about these two points that differentiate them from other huge asset classes:

- They can print however much money they want

- They can change the rules whenever they want

…………..this is not good folks!

“Spasibo” to my Russian Drugh!

For a full synopsis of everything Syndicate & Secondary from today’s debt capital markets as seen from the perch of Mischler’s Fixed Income Syndicate and Capital Markets desk(s), please visit the commentary section of Mischler’s website via this link