MarketsMuse update courtesy of debt capital markets desk notes distributed to clients of boutique brokerdealer Mischler Financial under the banner “Quigley’s Corner”. Mischler Financial, the financial industry’s oldest and largest minority firm owned/operated by Service-Disabled Veterans received the 2015 Wall Street Letter Award for Best Research/BrokerDealer.

Well, it’s finally Friday and every Friday is a Good Friday! So, let’s take a look back at the amazing week the investment grade corporate debt market has just concluded.

- This week was the second busiest in history for all-in IG volume (Corps+SSA) at $65.03b.

- It is now the fourth busiest all-time as measured by the number of individual tranches priced for all-in IG Corporate plus SSA issues with 63tranches priced.

- In terms of IG Corporate only supply the week’s $54.03bn ranks 5th all-time in that category.

- Market tone remains firm with CDX IG23 at a new low this morning of 60.12.

- The DOW and S&P are hovering around all-times highs both set this past Monday.

- Deals are performing well, NICs remain skimpy averaging 3.16 bps across this week’s 59 IG Corporate-only prints and demand is very strong with those 59 issues averaging a 3.55x bid-to-cover rate.

- The U.S. NFP number was upbeat blowing by estimates or 295k vs. 235k and the EU will be purchasing assets launching EU QE as early as Monday’s session.

- The average spread daily compression across today’s 59 IG Corporate-only new pricings was 16.28 bps from IPTs to the launch.

- Spreads across the 4 IG asset classes are an average 21.00 bps wider versus their post-Crisis lows and versus 23.50 last Friday or 2.50 bps tighter on the week!

- Spreads across the 19 major industry sectors are an average 25.32 bps wider versus their post-Crisis lows and versus 28.21 bps last Friday or 2.89 bps tighter!

- BAML’s IG Master Index was unchanged at +131 versus yesterday but 6 bps tighter versus last Friday’s +137 although rebalancing took place thanks to Petrobras being dropped due its high yield rating.

- Standard & Poor’s Global Fixed Income Research was at +171 versus +173 one week ago or 2 bps tighter.

- Taking a look at the secondary trading performance of this week’s IG and SSA new issues, of the 63 deals that printed, 51 tightened versus NIP for a 81.00% improvement rate while only 4 widened (6.50%), 7 were trading flat (11.00%) and 1 was not available (1.50%).

What else do you need to know? Listen to Hilsenrath or the-guy-in-the-corner?

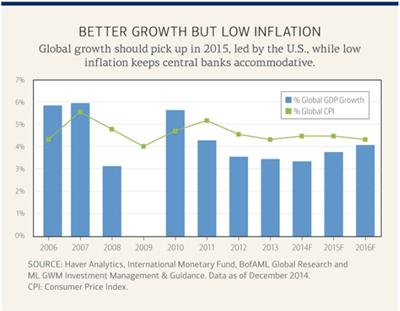

The market disappoints. Just because of today’s NFP number even “if” there’s a rate increase sometime this summer, it will not be followed by rate hikes every time the FOMC meets. Market traders make their living in real time. 152k of today’s 295K NFP number came from Leisure, Hospitality, Education, Health and Retail. So you sit back and ask “ And????.” C’mon readers those are all low paying jobs! The state of our recovery is slow BUT it has this going for it – it’s the best story going in the global economy. There’s a lot of pain coming around the world folks. The market is overreacting. There is way too much bad out there in our inextricably global-linked world economy. Look at the EU, China’s slowgrowth problems, Oil –need I say more, Ukraine/Russia, MENA discord, the Japanese debt crisis, the anticipation of rate change and subsequent impact, the strong dollar and plunging Euro, the impact on EM nation’s a a Chinese slow-down….okay? Do you get it? There’s way too much stuff out there that is headline news on its own. They’ve been there and in here a loooong time. Many have gotten much worse.

So, listen to the guy-in-the-corner. The EU is going to have it tough. Lower-for-longer is the right approach. The window is wide open folks for continued prolific issuance. We’ll see that again next week. In fact, if one backs out last week’s exceptional $21b Actavis transaction we’ll be seeing more issuance next week than this (ex-“ACT”). Stay thirsty my friends!

Syndicate Forecasts and Sound Bites from “The Best and the Brightest!”

Above is the opening extract from Quigley’s Corner aka “QC” Friday Mar 6 edition distributed via email to clients of Mischler Financial, the investment industry’s oldest and largest minority investment bank/institutional brokerage owned and operated by Service-Disabled Veterans.

Cited by Wall Street Letter for “2015 WSL Award, Best Research/BrokerDealer,” the QC observations provide a daily synopsis of everything Syndicate and Secondary as seen from the perch of our fixed income trading and debt capital markets desk and includes a comprehensive “deep dive” with optics on the day’s investment grade corporate bond new issuance and market data encompassing among other items, comparables, investment grade credit spreads, new issue activity, secondary market most active issues, and upcoming pipeline.

To receive Quigley’s Corner, please contact Ron Quigley, Managing Director and Head of Fixed Income Syndicate via email: rquigley@mischlerfinancial.com or via phone: 203.276.6646

*Sources: Bank of America/Merrill Lynch, Bloomberg, Bond Radar, Dow Jones Newswire, IFR, Informa Global Markets, Internal Mischler, LCDNews, Market News International, Prospect News, Standard & Poor’s Ratings Services, Stone & McCarthy Research, Thomson Reuters and of course, a career of sources, contacts, movers and shakers from syndicate desks to accounts; from issuers to originators; from academicians to heads of research, and a host of financial journalists, et al.

Mischler Financial Group’s “U.S. Syndicate Closing Commentary” is produced weekly by Mischler Financial Group. No part of this document may be reproduced in any manner without the permission of Mischler Financial Group. Although the statements of fact have been obtained from and are based upon sources Mischler Financial Group believes reliable, we do not guarantee their accuracy, and any such information may be incomplete. All opinions and estimates included in this report are subject to change without notice. This report is for informational purposes and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Mischler Financial Group, its affiliates and their respective officers, directors, partners and employees, including persons involved in the preparation of this report, may from time to time maintain a long or short position in, or purchase or sell a position in, hold or act as market-makers or advisors or brokers in relation to the securities (or related securities, financial products, options, warrants, rights, or derivatives), of companies mentioned in this report or be represented on the board of such companies. Neither Mischler Financial Group nor any officer or employee of Mischler Financial Group or any affiliate thereof accepts any liability whatsoever for any direct, indirect or consequential damages or losses arising from any use of this report or its contents. “Mischler Financial” Group and the Mischler Financial Group logo are trademarks of Mischler Financial Group. All rights reserved.