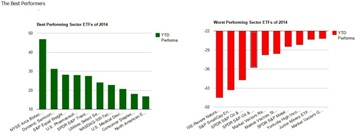

Bloomberg’s Eric Balchunas reviewed the best and worst of ETFs in 2014. Below are excerpts from Balchunas’s article. The pace of new ETF launches has also picked up, and the 196 new offerings in 2014 is a 29 percent jump over 2013. There are now ETFs for about everything you can think of — and 1,000 more in registration with the Securities and Exchange Commission. The ETFs that did best in 2014 were tied to lower interest rates, sinking oil prices and a surging U.S. dollar. To come up with this year’s ETF Awards, Bloomberg senior ETF analyst Eric Balchunas considered performance, how much cash a fund attracted and how well an ETF was able to capitalize on trends.

Best/Worst U.S. Equity ETF

Best: The First Trust NYSE Arca Biotechnology ETF (FBT)

Biotech ETFs led a booming health care sector, and FBT led them all. It returned 47 percent, capping a five-year run that has it up 264 percent. FBT showed the upside of ETFs that give every stock an equal weight, rather than letting the biggest stocks dominate the portfolio. Such egalitarianism means the ETF can tilt toward smaller, more volatile stocks — stocks that typically lead a rally. FBT beat its rivals by five percentage points, and brought in $570 million in new cash.

Worst: The SPDR S&P Oil & Gas Exploration (XOP)

Okay, so there’s also a downside to weighting all of your portfolio stocks equally — the same stocks that lead a rally often fall the hardest when the music stops. The sharp drop in oil prices slammed the SPDR S&P Oil & Gas Exploration ETF — it lost 36 percent.

Best/Worst U.S. Fixed-Income ETF

Best: iShares 20+ Year Treasury Bond ETF (TLT)

TLT was a total pariah in 2014. A slew of pundits predicted that interest rates would rise and crush returns on long-term bond ETFs such as TLT. Instead, rates fell and TLT returned 27 percent. It became a cash magnet, attracting $3 billion. It was the only fixed-income ETF to return more than 20 percent in 2014, and to rake in more than $2 billion in cash.

Worst: AdvisorShares Peritus High Yield ETF (HYLD)

Bond ETFs joined equity ETFs like XOP in suffering a painful oilbath. The worst of them all: Energy-heavy AdvisorShares Peritus High Yield ETF lost 9 percent. HYLD’s freedom to pick whatever junk bonds and high-yielding equities it wants worked like a charm in 2013, when it was up 12 percent. This year? Not so much.

To see the complete list of the best and worst ETFs in 2014 click here.