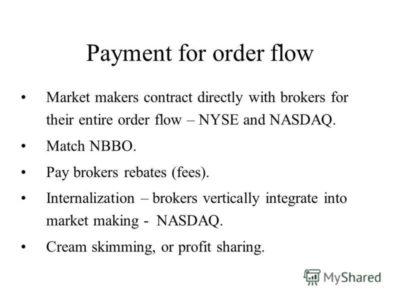

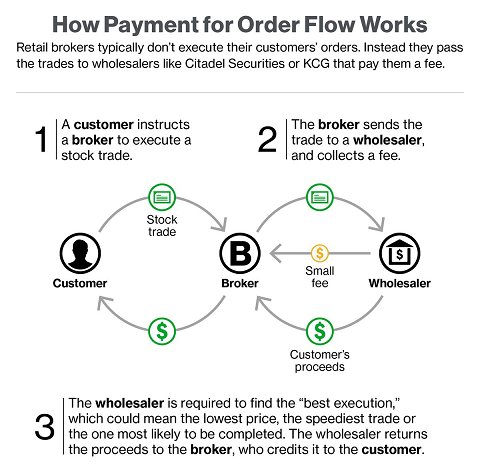

Broker Rebates From Exchanges and HFT Firms May Be Securities Fraud, Says Federal Judge Broker Rebates, Payment-for-Order-Flow ("PFOF") and "Pay-to-Play" have become synonymous with new world order in which exchanges, dark-pool operators and high-frequency trading ("HFT") firms, (the so-called "flashboys") dominate the world of stock trading. While many Wall Street…Read More

Start-up corporate bond trading system OpenBondX is hoping to pull a rabbit out of its hat and jump start activity by emulating what the universe of equities-centric electronic exchanges and ATS platforms do in order to attract order flow to their respective venues: pay broker-dealers for orders given to them…Read More

On the heels of the recent NYSE ‘outage’, which actually had little impact on overall equities trading volume, but did lead to volume spikes away from the NYSE and at competing exchanges across the fragmented marketplace, the volume also increased with regard to spirited discussions about market structure. And, whenever…Read More

MarketsMuse options market update courtesy of extract from our friends at MarketsMedia LLC and their profile of yet another proposed options exchange with yet another “rebate” scheme intended to capture market share in the very competitive world of order routing. International Securities Exchange will have its ISE Mercury exchange ready…Read More

For those who missed the MarketsMuse memo from Jan 14, there appears to be yet another exchange coming to the US Equities markets, as if the industry needs one more platform to facilitate trading in publicly-listed stocks. The latest platform, which is still on the whiteboard, is a consortium-based initiative…Read More

In a July 18 NYT op-ed piece "Wall Street Profits by Putting Investors in the Slow Lane" submitted by Jonathan Macey, a professor at Yale Law School and David Swensen, the chief investment officer of Yale University, the spirit debate topic of payment-for-order-flow schemes, aka rebates paid by the various stock exchanges to…Read More

Within the context of market structure, the ever-evolving rules of the road for those attempting to navigate how and where to secure best pricing when executing equities orders has become so convoluted thanks to pay-to-play rebate schemes, its not only the curators at MarketsMuse who are scratching their heads, even…Read More

Former Lehman Bros capo Richard Fuld likes acronyms, and somewhat out of character for the Big Dick many on Wall Street remember him to be, he also apparently likes the idea of inserting himself into a consortium that has created yet another new exchange platform--that eschews the notion of maker-taker…Read More

When ETFs were first launched in 1993, the 'framers' might not have fully appreciated what would happen to the respective ETF cash index in the event of a lopsided market opening when the underlying constituents had not yet opened for trading, despite the easy recall of October 1987.. Since that…Read More

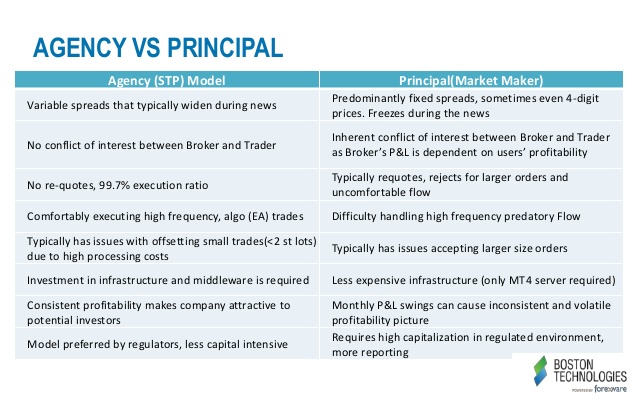

MarketsMuse dip and dash department frequently prefers spotlighting altruists and do-gooders, including Agency-only execution firms in the brokerdealer sphere who, unlike “principal trading desks”, do not take the contra side to institutional customer orders as a means of making a profit; agency-only firms merely execute those client orders via the…Read More

MarketsMuse senior editors have quickly canvassed a broad assortment of "market structure experts" and industry talking heads who have been at the forefront of debating the pros and cons of market electronification, multiple market centers and the underlying issue: "Is Market Fragmentation Good, Bad or Ugly?" For those who might…Read More

MarketsMuse.com Strike Price section profiles trading systems vendor Dash Financial algorithm-based approach to securing options market “best execution” in the ever-increasing world of options mart fragmentation and the wacky rebate schemes that have proliferated across the electronic options exchange landscape. Below is courtesy of extracted elements from MarketsMedia.com April 20…Read More

NYSE CEO Says "Not Good" while appearing before Senate on the topic of equities market structure and Maker-Taker Rebate Schemes. Bowing to increasing pressure from regulators, law makers and law enforcement officials, Finra, the securities industry "watchdog" has launched its own probe into how retail brokers route customer orders to…Read More

Conflict of Interest is Of Interest to Senate Panel Members "just learning about" industry-rampant Payment For Order Flow Schemes . Market Structure To Be Re-Structured? Excerpts below courtesy of The Wall Street Letter's on the spot coverage of the U.S. Senate investigation of Wall Street's affection for high-frequency trading aka…Read More

MarketsMuse Editor Note: Finally, the topic of payment for order flow, the questionable practice in which large brokerage firms literally sell their customers' orders to "preferenced liquidity providers", who in turn execute those orders by trading against those customers orders ( using arbitrage strategies that effectively guarantee a trading profit…Read More

Excerpt courtesy of April 15 edition of WSJ and reporters Scott Patterson and Andrew Ackerman. A fee system that is a major source of revenue for exchanges and some high-frequency trading firms is coming under the heightened scrutiny of regulators concerned that market prices are being distorted, according to top…Read More

(Bloomberg) -- Regulators could stem the migration of U.S. equity trading to dark pools by coordinating a cut in trading fees, an action exchanges are unlikely to take on their own, according to one of the biggest high-frequency firms. Most exchanges are charging traders too much -- 30 cents per…Read More

Courtesy of AdvancedTrading Contributor Phillipe Buhannic Editor Note: This article is endorsed by MarketsMuse sponsor OMEX Systems, Inc. Buy-side clients need to understand that when they trade on a broker-sponsored platform, they are paying for these systems, whether that payment comes in the form of commissions, licenses, or widened spread.…Read More