So-called President Trump’s Secretary of Treasury Steve Mnuchin is hoping to cash in on a cache of US $1000 dollar-denominated 1927 Republic of Estonia Bonds, according to credible sources who were privy to wire-tapped discussions between Mike Flynn, the one-time National Security Advisor to Donald Trump and Sergey Kislyak, the Russian Ambassador to the United States. The cache of Estonia Govt bonds is said to be worth as much as $200,000.

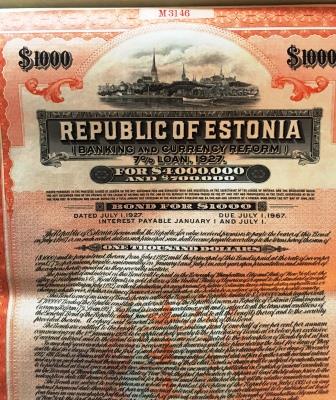

The bond issuance from 1927 by the Republic of Estonia carried a 7% coupon with a 40-year maturity and the offering totaled US $3.7 million. Estonia paid interest on those notes up until the spring of 1940 when Russia invaded Estonia, and in June of that year, the government of Estonia ceded sovereign control to the then USSR. The debt obligations, which included a 10mil pound sterling tranche, were subsequently deemed by the Russian government as ‘no longer in force,’ and holders of the debt have pursued litigation for years thereafter. When Estonia’s independence of Russia was restored in 1991, new litigation was filed in US Courts by debt holders, but those efforts “barely made it out of the barn” according to a Florida-based attorney who attempted to re-start the claim process on behalf of individual investors who had purchased the bonds or inherited the holdings from family members.

At least one of the very few other actual holders is apparently not aware of Mnuchin’s so-called effort, as evidenced by that individual’s offer to sell as many as seventy 1927 Estonia bond certificates on eBay for 20% of the $1000 face value.

*31 March 2017 -Story Update- Subsequent to the 11 March publication of this MarketsMuse exclusive story, transactions reported on eBay indicate multiple trades of increasing prices; the current bid-offer market for above-referenced 1927 Government of Estonia USD 1000 7% bond certificates has rallied from under $200 to current asking price of $289 Rumors as to whether price spike is related to former National Security Adviser Michael Flynn’s request for immunity from prosecution in consideration for his testimony regarding Russian connections remain unconfirmed.

Throughout and since the 2016 Presidential Primaries, there has been a broad assortment of revelations in which multiple former and current Trump Administration officials have been found to have had private discussions with Russian Ambassador Kislyak, as well as various others connected to the top echelon of the Russian government in the months leading up to and days after the 2016 presidential election. Mnuchin’s alleged effort to cash in on a cache of bonds now estimated to be worth at least $200,000 when calculating accrued interest on the notes is the latest in a series of Surreality TV-like episodes broadcast from the Trump-owned White House. Mnuchin is a former Goldman Sachs executive who has since dabbled in the creative-finance world of Hollywood film producer roles.

Wall Street historians who specialize in pre World War II bond and stock certificates have suggested that most sovereign debt certificates issued prior to WWII are now mostly valued based on ‘antique/collectible’ metrics. A spokesperson for the Museum of American Finance suggested “the 1927 Republic of Estonia bonds would only be an exception if a senior US government treasury official would have good reason to push the Russians into honoring the debt based on the ‘you break it, you own it doctrine’ invoked in such government take-over instances.”

If you’ve got fintech fever, or just a hot tip, a bright story idea profiling global macro, fintech, ETFs, options, or fixed income markets, or if you’d like to get visibility for your firm through MarketsMuse via subliminal content marketing, advertorial, blatant shout-out, spotlight article, etc., please reach out to MarketsMuse Corporate Communication Concierge via this link Continue reading