BlackRock is the latest firm to embrace Symphony Chat Platform; Another Shot Across Bloomberg Bow

In early 2014, when David Gurle, a former Reuters exec started to chat up a scheme with prospective banking industry investors that would offer a low cost alternative to Bloomberg LP’s ubiquitous instant message / chat application, prospective strategic investors were more than intrigued. After all, Bloomberg had long held a virtual monopoly on the most critical application used across financial markets, one that enables traders and managers to rapidly communicate indications of interest for large-scale transactions And, because Bloomberg only provides bundled applications within its subscription model, many terminal subscribers who only use that platform for instant messaging have long been handcuffed to annual terminal fees that approach $25,000 per user for the simple privilege of instant messaging. Guthrie’s idea was not only intriguing, it was seen as an epiphany moment by a start-up investing group within Goldman Sachs led by a fellow named David Cohen, who long expressed concerns about Bloomberg’s toe-hold on trading desk communications.

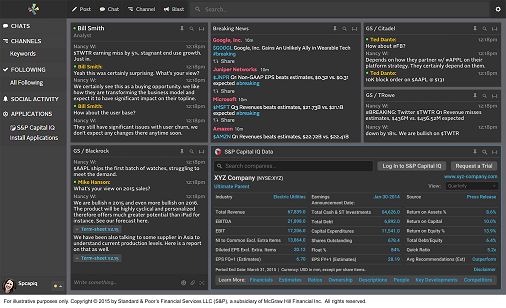

Soon thereafter, a consortium of banks and buyside firms pumped nearly $70 million into the startup named Symphony, each sharing the same goal of hoping to save millions of dollars on Bloomberg subscription fees and via a more secure way to communicate with trading desk counterparts away from watching eyes of Bloomberg’s black box. Nearly 2 years since that first funding round, the company has received approximately $100mil to fund its David v. Goliath battle. Now that Blackrock has joined the Symphony party, the fintech company’s still slow path to prominence is hoped to hasten. Below excerpt from WSJ frames the latest chapter..

By JUSTIN BAER and SARAH KROUSE

June 23, 2016 7:00 p.m. ET

The world’s largest money manager is trying to change the way Wall Street chats.

BlackRock Inc. will urge banks, brokers and others who interact with it to communicate via a messaging platform backed by banks and investment firms called Symphony Communication Services LLC, according to people familiar with the matter.

The asset manager, also an investor in Symphony, started testing the system with thousands of employees internally last year and now has moved all internal chat messaging to the service, the people said.

The hope from those backing Symphony is that BlackRock’s push will help jump-start the service’s use across the financial-services industry.

Symphony was created as an alternative to Bloomberg LP terminals, long a hallmark of trading floors and an expense banks have struggled to trim. The firms also like Symphony’s secure-messaging technology.

Despite the fanfare that followed Symphony’s late-2014 launch and last year’s $100 million funding round that included an investment from Alphabet Inc.’s Google, Symphony has yet to gain widespread use, according to traders across Wall Street.

At Goldman Sachs Group Inc., a Symphony investor that contributed its own messaging developments to the platform, the service is now used by most of the firm’s employees across all of its businesses, according to a person familiar with the situation. Goldman traders, for instance, use Symphony to communicate with back-office employees charged with settling trades.

Elsewhere, though, Symphony remains little used or, in some cases, virtually unknown.

To continue reading, click here