Knowing that nearly every reader has already consumed as many financial market predictions for the new year as they can stand, we decided to wait for the official first day of 2024 to publish our financial market predictions and outlook, if only because Santa Claus rallies that find Santa slipping from his sled during the last day of a year (one in which markets failed to close at an ATH), and followed by rinsing of markets the days into the first week of the new year (as is the case for 2024), can cause technical chart pundits to re-assess outlooks they made only a few weeks earlier. If the first day of 2024 is an indication (AAPL downgraded and down 3.5% and all major indices down .5% to 2%+) expect strategists to re-strategize! But that’s what pundits are best at doing: changing their views to address changes in price trends.

Here’s what we learned from 2023: Nearly all market prognosticators were wrong; at the outset of the year, and then they were caught “offsides” at least three or four times during the year; which is perhaps the only reliable statistic that we can confidently hang our hats on!

Let’s “go to the videotape”

At the close of 2022, after equities were pummeled (S&P 500 down 19.5%; Nasdaq Composite down 33%; Russell 2000 down 21.5% and DJIA down 8.9%), a December Bloomberg LP poll of 22 “top strategists”, had them proclaiming: “2023 will be, at best, a lackluster year”; with the mean prediction suggesting gains of 7% for the year.

At the time, those outlooks made sense. After all, the Fed was barely mid-way through a record-setting rate-hiking mode to battle inflation, and with [most] market participants of the view that we were moving towards an interest regime of 5% (which is actually within the historical 4%-6% range going back decades), equities and interest rate prognostics were certain that stocks would underperform historical average gains.

During the first month of 2023, SPX rallied 10%, inspiring the naysayers to turn bullish, raise their price targets, and get long on stocks at January month end. By the end of February, half of the gains achieved through January 30 were extinguished, and by the first week of March, SPX, the most-followed index, had reverted to exactly where the year had begun. That up-and-then-down price action led the crystal ball crowd to revisit and temper down their year-end outlooks.

As is typically the case, that exuberance encountered a dose of reality. Market participants chose to ignore the consistent signals sent by the Fed (i.e. “Do NOT expect a cut in interest rates, as our fight to bring inflation back to target levels is far from over!”). Instead, many called the ‘all clear’ signal—with an increasing number of strategists pointing to year-end 2023 SPX of 4500. Of course, equities swooned over the next three months into the end of October, albeit by a factor of a mere 9%; a classic ‘reversion to the mean’ that brought that major index back to 4115. That was approximately the level that had been the year-end 2023 forecast made by Pundits Inc in December 2022. And, by this time, most had dismissed any likelihood that equities, as benchmarked by SPX, could end the year higher than 4350.

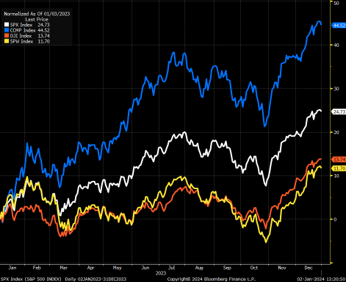

And, we all know what happened by the end of October. Thanks to a compilation of lower inflation and resilient economic data points that discounted the notion of a pending recession, and sweetened by a dovish voice from the Fed, every negative narrative turned upside down. SPX closed 2023 at 4775, up 24% on the year, NASDAQ ended the year with a gain of 34%, and to illustrate the broadening of the rally from the end of October to the end of December, the DJIA closed the year up 13%, the equal-weighted S&P 500 (see ticker RSP) gained 11%, and long-time laggard Russell 2000 index finished the year with a 15% gain.

Some predictors did get it right; select strategists from BMO, BofA, and the always bullish Tom Lee, who runs a firm called “Fundstrat” accurately guessed at the outset of 2023 that a variety of best-case scenarios would come to fruition. These firms, as well as a majority of sell-side strategists, are determined that 2024 equity market returns will prove positive. The median projection calls for the S&P 500 to rise by 8% (5100), and the staunchest bulls, including market veteran Ed Yardeni of Yardeni Associates (who proved uniquely prescient for his 2023 outlook) believe the S&P 500 can reach 5400 by year-end 2024. The most notable bears throughout the past three years i.e. Mike Wilson from Morgan Stanley and JP Morgan’s Marko “Kill Joy” Kolanovic remain pessimistic, yet less bearish than usual. Wilson is forecasting a slight drop for 2024 (year-end target of 4500) and Kolanovic believes that current (high) equities valuations, historically low volatility, and any of several prospective black swan events could find the SPX back at 4200.

FACTOIDS that lend [some] confidence to a positive 2024 equity market performance.

·According to LPL Research going back to 1950, 80% of the time in years following a gain of 20% or more have seen the S&P 500 rise an average of 10%.

·Since 1960, in periods where the SPX was down 10% or more, then up 10% or more the following year, there has been no instance where the SPX ended down in the third year. ·

·Fortune 500 balance sheets remain relatively strong; debt levels remain manageable, and profit margins remain respectable, despite a long stretch of higher wages, higher cost of goods, and rising debt among consumers.

·The advent of Artificial Intelligence (AI and Generative AI) has permeated throughout the corporate world; leading to increased spending and investments that will [presumably] lead to higher productivity, greater efficiency, and hence, greater profit margins for companies in nearly every sector, even if the bottom-line returns may not begin to be noticed until the end of 2024 at the earliest).

Irrespective of Federal Reserve decisions to continue to pause, lower, or even raise interest rates in the coming year, the yield on the 10 year UST is NOT a long-term harbinger of equities prices; the average 10-year yield going back to 1970 is approximately 5.5%*

Concerns to Be Mindful Of

·Too Early Rate Cut by Fed (in their effort to mitigate risks of recession). ·Geopolitical Risk | Black Swan Event* (Russia/Ukraine; China/Taiwan; Middle East)

·Vast Majority of Equities Strategists are Bullish.

*Caveat: Black Swan events, including the assortment of pandemics, wars, and bank failures, and major changes in government leadership that have occurred during the last three years alone (and may occur in the coming year) rarely cause extended (i.e. long-lasting) losses in major equity indices.