Courtesy of Brad Zigler. This article first appeared in the February 2013 issue of REP/WealthManagement.com.

In 2013, the market for alternative investment exchange-traded products seems to revolve around one word. That word is “hedge.” Judging by their proportion of regulatory filings and launches last quarter, product sponsors are keen on risk-controlled equity and bond plays.

No surprise there, really. After all, we’re just emerging from one of the most volatile periods in market history. Investors – and their advisors – are still a little dizzy after being buffeted by the frets of an impending “fiscal cliff,” a meltdown of the eurozone, further ballooning of the federal deficit and fears of potential asset bubbles.

Overall, the prospects for 2013 are mixed at best. Stocks, while not the raging bargains they were during the recent recession, may still be attractively priced, but their dynamics have changed. The recent equity rebound has largely been market driven. Value plays, starting in early 2009 as corporate profits widened, are now becoming sparse. Currently, the market is reacting more to political influences such as Fed policy and the deficit debate, causing some pundits to forecast an even riskier environment ahead. With such prospects, they say, a little hedging and bond buying seems prudent. Exchange-traded product manufacturers are happy to oblige.

Hedged Equity

Funds and notes geared to dampen market volatility have proliferated in the wake of the 2008-2009 crash. Some have enjoyed extraordinary success attracting assets. Witness, for example, the Invesco PowerShares S&P 500 Low Volatility Portfolio (SPLV), which has pulled in more than $3 billion since its May 2011 debut. SPLV is essentially a passive hedge. The fund mirrors a 100-stock portfolio, carved from the S&P 500 Index, representing issues with the lowest 12-month trailing volatility.

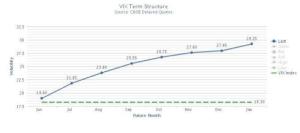

Invesco now offers investors a more sophisticated approach to managing volatility with its December 2012 launch of the PowerShares S&P 500 Downside Hedged Portfolio (PHDG). Like SPLV, the new PowerShares fund invests in U.S. stocks but hedges downside risk through futures contracts linked to that well-known “fear gauge,” the CBOE Volatility Index (VIX). Continue reading